US futures

Dow future 0.1% at 39885

S&P futures 0.09% at 5430

Nasdaq futures 0.1% at 19050

In Europe

FTSE -0.20% at 8136

Dax -1% at 18189

- Stocks halt steep selloff

- Q2 GDP rose 2.8% annualized, up from 1.4%

- Earnings season rolls on, with 25% of firms in the S&P500 having reported

- Oil falls to a 6-week low on China demand concerns

US GDP calms hard landing fears

U.S. stocks have halted the deep sell-off as better-than-expected economic growth in the second quarter helped to ease fears that the Fed may need to rush rate cuts to prevent a recession.

US GDP rose at 2.8% annualized in Q2 after 1.4% in Q1. This was well ahead of the 2% growth forecast. Meanwhile, personal spending, a key driver of growth in the US economy remained strong at 2.3%, also ahead of forecasts. The data helps to reinforce the view that the Fed has time on its hands, so there's no need to rush rate cuts through this month to prevent a recession.

With this in mind, the July FOMC remains a set-up meeting for a September rate cut.

The data has helped boost the market mood after the Nasdaq fell almost 4% yesterday in its worst daily performance since 2022. Underwhelming mega-cap earnings raised questions about lofty valuation, resulting in a tech-led selloff, and fears of a hard landing pulled stocks lower.

The market has been turning cautious regarding several key factors that had previously been driving forces. Disappointingly, numbers from Tesla and Alphabet raised questions over whether the big AI trade will pay off. Meanwhile, faltering earnings in Europe, concerns over Chinese economics, and US political uncertainty are creating a toxic mix for the market.

Meanwhile, earnings continue to roll in. More than 25% of companies in the S&P 500 have posted second-quarter earnings; there have been some significant tech stocks disappointments. However, the overall picture is that the earnings season has been positive so far.

Corporate news

Ford has slumped after the auto giant posted a significant profit miss in the second quarter. As it continues to battle quality issues and as the EV business weighs on its bottom line, Ford posted an EPS of $0.47, well below expectations of $0.68.

Chipotle Mexican Grill is expected to open higher after posting stronger-than-expected earnings. The fast-food chain logged strong parable restaurant sales.

IBM rose 4% after increased interest in AI, which helped the tech consulting firm post stronger-than-expected earnings.

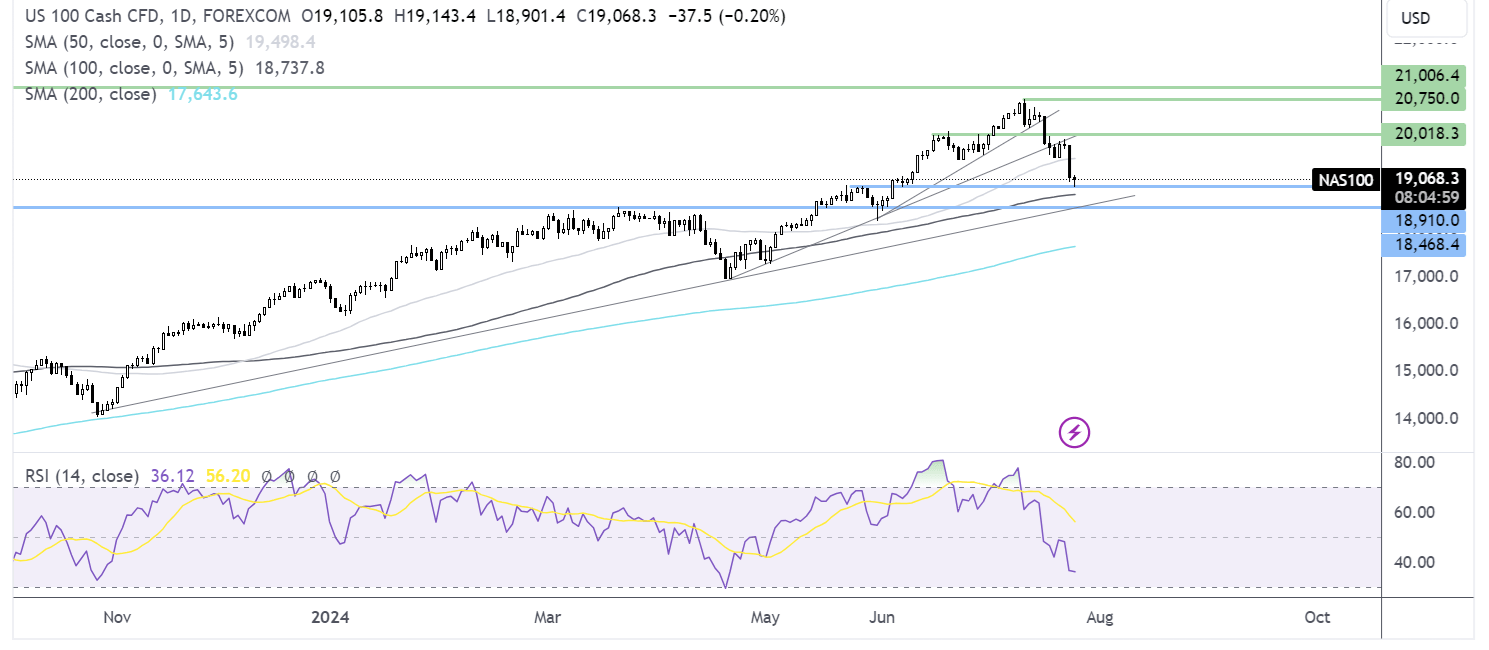

Nasdaq 100 forecast – technical analysis.

The Nasdaq 100 fell sharply before finding support at 19,000 the round number and May high. Sellers supported by the bearish engulfing candle and the RSI below 50 could look to extend losses towards 18465, the March high and multi-month rising trendline. Any recovery would need to retake the 50 SMA at 19500 ahead of 20,000.

FX markets – USD falls, GBP/USD rises

The USD has recovered from session lows following stronger-than-expected GDP data. However, gains could be limited given the cooling PCE index in Q2 and ahead of tomorrow’s inflation data.

EUR is rising despite an unexpected decline in German business morale. The Ifo German business sentiment index unexpectedly dropped to 87, down from 88.6 in June, defying expectations of a rise to 88.9. The data comes after weaker-than-expected PMI figures yesterday, which show that business activity in the eurozone's largest economy fell back into contraction, dragged lower by a worrying manufacturing PMI.

USD/JPY has fallen to a 12-week low amid the unwinding of the carry trade and as the yen benefits from safe-haven flows. Attention turns to next week's Bank of Japan meeting, where policymakers could raise interest rates by 10 basis points. At the same time, the market is increasingly convinced that the Fed will cut rates in September.

Oil falls on weak Chinese demand

Oil prices have slumped further as concerns over China's demand outlook overshadow a significant drawdown in US inventories.

The Energy Information Administration revealed that US crude inventories fell by 3.7 million barrels in the previous week, compared with the expected 1.6 million barrel draw. Meanwhile, gasoline stockpiles fell by 5.6 million barrels, against expectations of just a 400,000 barrel draw.

Yet despite signs of solid demand in the US, concerns over China’s bumpy economic recovery and the prospect of a ceasefire between Israel and Hamas are keeping oil prices under pressure.

In China, oil imports and refinery runs have fallen amid weaker fuel demand and sluggish economic growth.

Meanwhile, optimism surrounding a ceasefire deal over the war in Gaza is gaining momentum in the Middle East, taking some of the risk premium from oil prices.