Markets are seeking equilibrium ahead of three major central bank meetings, which kick off with the BOJ and FOMC on Wednesday before the BOE on Thursday. Should the Fed fail to deliver anything compelling, the focus then shifts to ISM and NFP reports on Friday. I doubt the Feed will cut rates this week given their reluctance to provide any such clues or guide market pricing to such an expectation. But it would make sense of them to signal a September cut, if that is indeed their plan.

The bigger risk is that the BOJ don’t deliver the rate hike markets have gleefully priced in these past two weeks. Ueda remains as quiet as ever, and the BOJ have an established track record of underwhelming at recent meetings linked with expectations of action. And if history repeats, that could send the yen lower to the advantage of USD/JPY bulls.

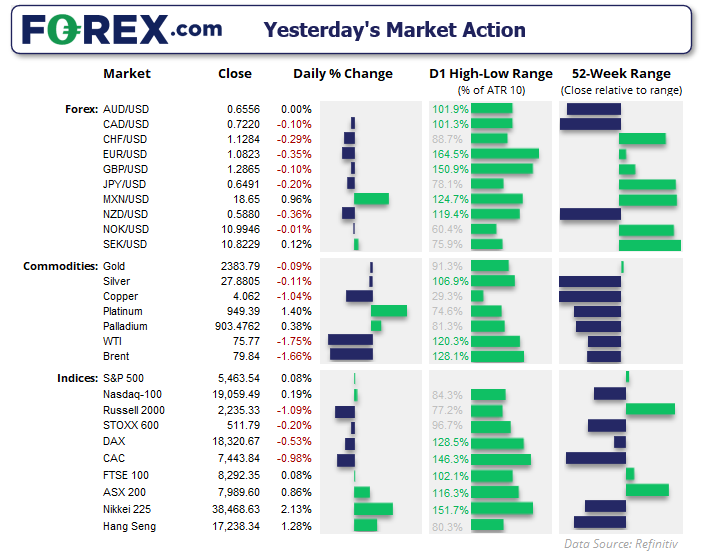

The US dollar index rose to a 13-month high, thanks a drop on EUR/USD which tested (but failed to close beneath) its 200-day average. Regardless, the US dollar index remains trapped between its 50 and 200-day EMAs ahead of key events, which could mean choppy trade over the next 36 hours.

The basic theme is that markets that faced selling pressure last week are holding key support levels, with a few exceptions. Wall Street indices continued to edge higher against last week’s losses, helped by the VIX (volatility index) retracing lower for a second day from its 11-week high. Their downside moves appeared overextended, and their mild rebounds are more likely to be from short covering than a return of risk appetite, given their lack of bullish follow-through.

AUD/JPY traded within a tight range for a second day after recovering back above the 100 handle. Copper prices remained above Thursday’s low, where reports of Chinese buying kept the front-month futures market above $4. S&P 500 E-minis held above its 50-day EMA and remains above its October 2023 trendline, yet like the Nasdaq buyers aren’t exactly piling in at these levels. Nikkei 225 futures also remained in a tight range just above 38k, having recovered back above the May and June lows after last week’s bearish onslaught.

WTI crude oil was down -1.75% on headlines that Israeli officials saying they wanted to avoid bringing the Middle East into an all-out war.

Events in focus (AEDT):

- 09:30 – JP jobs/applications ratio, unemployment

- 11:30 – AU retail sales, building approvals

- 18:00 – DE state CPI

- 19:00 – EU ESI (European Sentiment Indicator), GDP

- 00:00 – US consumer confidence (CB), job openings (JOLTS)

USD/JPY technical analysis:

Thursday’s bullish pinbar held above the 200-day EMA, which coincided with the daily RSI (2) and (14) reaching oversold. The pinbar has not exactly led to a rebound, with daily open-to-close range of the past three days sitting at a mere 30 pips. The 1-day implied volatility band suggests it could be another quiet day, but the 1-week assumes volatility could well pick up and sits between 151.16 – 156.92.

The 1-hour chart shows that prices are trying to drift higher, with a low around 153 suggesting we could be within the ‘C’ leg of an ABC correction. The 1-hour RSI (14) is above 50 and confirming the recent leg higher.

A 61.8% Fibonacci projection lands just below the 155 handle, and the 100% ‘wave equality’ projection of A=C sits just below 156. We’d likely need a less-dovish-than-expected Fed and less-hawkish-then-expected BOJ to see a decent rally. And that scenario may not be so unlikely.

A break below 153 invalidates the near-term bullish bias of a run higher to 155 and 156.