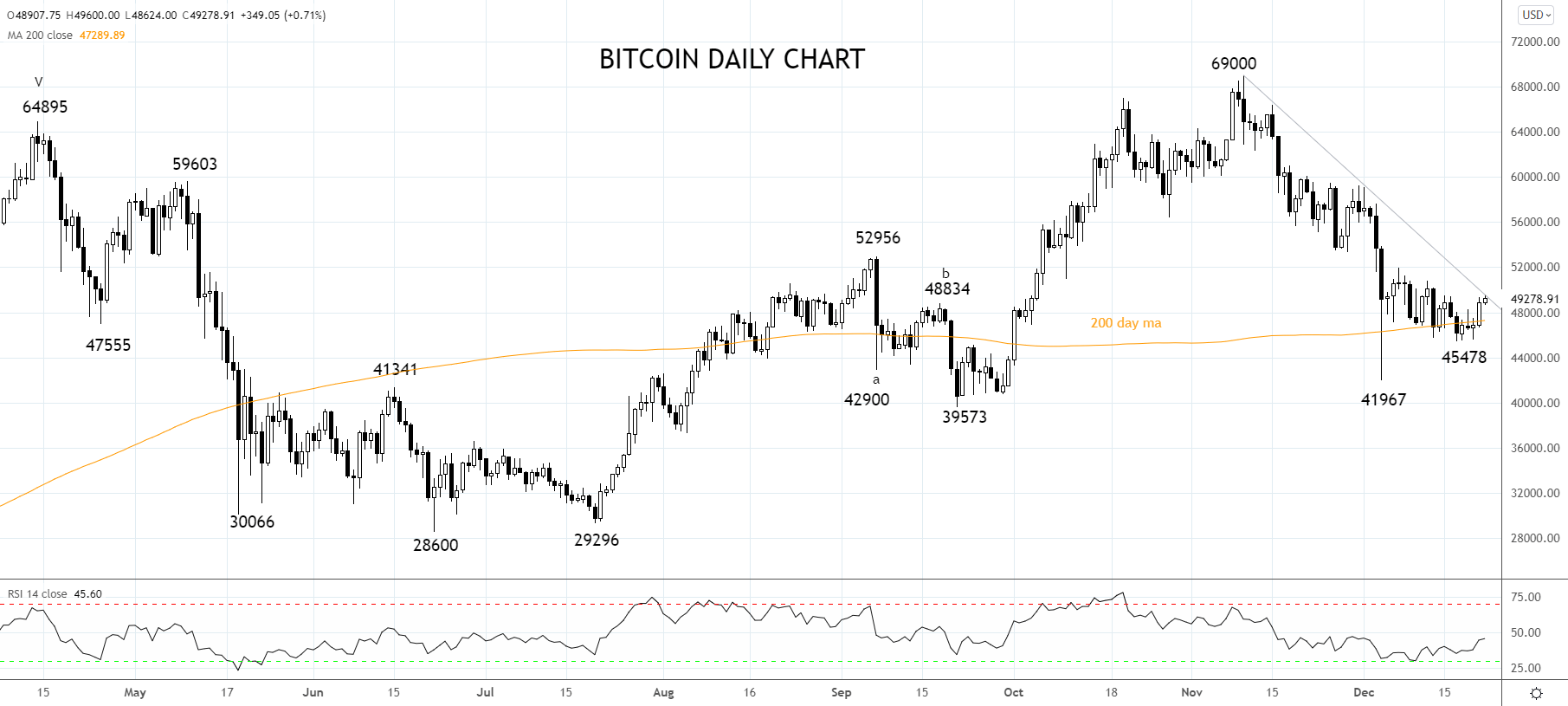

Despite its progressive scarcity due to the halving events that take place roughly every four years, Bitcoin's narrative as a form of digital gold has lost considerable lustre over the past six weeks, following hawkish shifts by the Federal Reserve, the Bank of England, and the ECB.

Not to mention Democratic Senator Joe Manchin voting against U.S. President Joe Biden's $2tn Build Back Better Act, citing the ballooning national debt, Bitcoin remains almost 30% below its November $69,000 high, trading near $49,300.

Encouragingly, apart from the brief moments that followed its "flash crash" in early December, Bitcoin has for the better part, maintained altitude above the 200-day moving average currently at $47,200, offering hope of a more robust recovery.

Should Bitcoin break above the downtrend resistance at $49,600 coming from the $69,000 high and then medium-term resistance at $53,000, it would be a good indication the correction from the $69,000 high is complete and the uptrend has resumed.

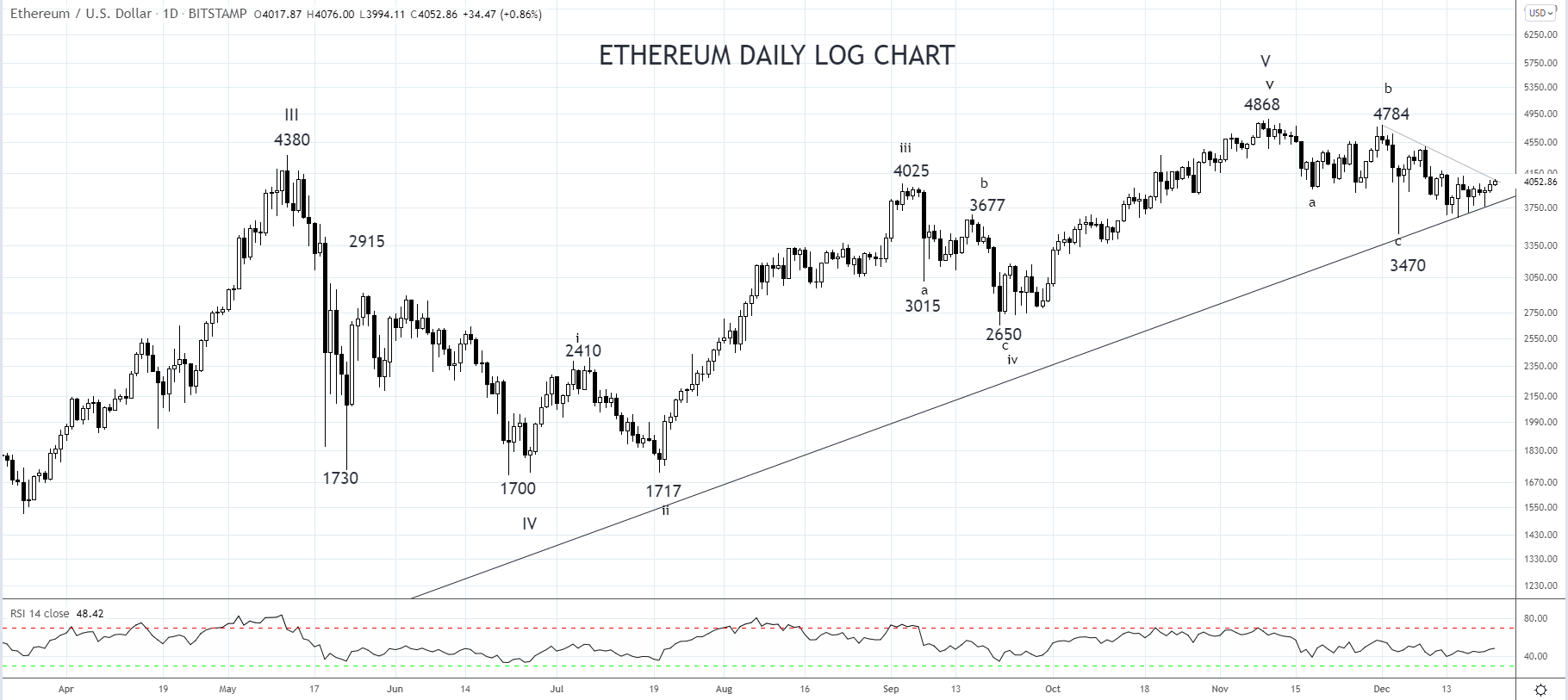

Elsewhere, Ethereum is much closer to generating a positive bias supported by its greater versatility, including its use in Defi and NFT's. Technically the decline from the all-time $4868 high to the "flash crash" $3470 low has bullish corrective characteristics after an impulsive move higher.

Should Ethereum break and close above downtrend resistance at $4080/4120, it would indicate the uptrend has resumed and that a retest and break of the November $4868 high is underway.

Source Tradingview. The figures stated areas of December 22nd, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.