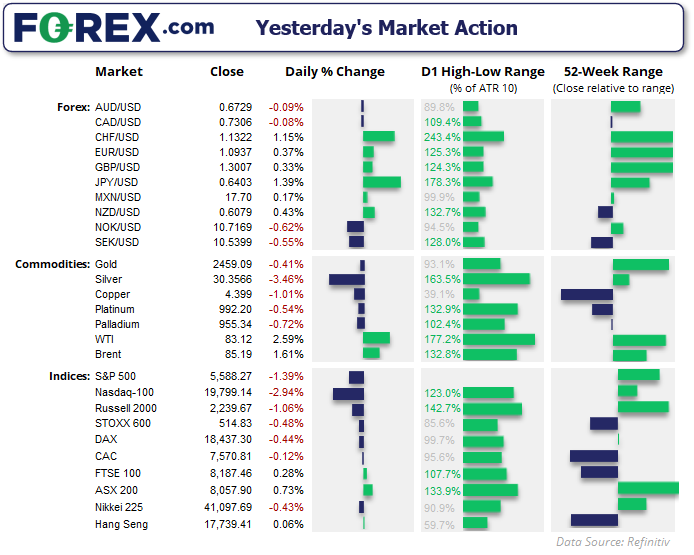

Japan’s Ministry of Finance (MOF) appears to be taking full advantage of the path of least resistance by intervening when the Fed change their narrative towards a dovish pivot. As it seems that the MOF once again intervened on the yen on Wednesday to send their currency broadly higher against all FX majors except the Swiss franc – which held its ground due to safe-haven flows.

- USD/JPY fell to a 5-week low after breaking daily trend support

- AUD/JPY is back below the 2013 high to a 4-week low

- The US dollar index closed beneath its 200-day MA on Fed cut bets

- GBP/USD closed above 1.30 to a fresh 1-year high

- EUR/USD rose to a 4-month high and now has 1.10 in its sights

The Fed are making the most of their final week of commentary before their media blackout period begins on Saturday. FOMC voting member Christopher Waller said that the Fed are closer to cutting rates, although they are not there quite yet. He is also optimistic about inflation continuing to soften. Barkin is sure that the Fed will discuss whether it is appropriate to describe inflation as "elevated" at their next meeting. Although he added that one 25bp cut will not change much, and it is more a case of deciding when the Fed needs to change the narrative.

Ultimately, the Fed script this week is playing out as expected: They are seemingly shifting their narrative from a single cut in December to their first cut arriving in September. Whilst markets have essentially priced this in with a foregone conclusion, it is an important step the Fed needs to make to effectively 'pivot' towards a cutting cycle.

WTI crude oil rose 2% as driving season ramped up, with as stockpiles dropping faster than expected. Clearly, the weaker US dollar also helped, alongside the Fed’s beige book pointing to lower inflation combined with slight economic growth (which points to a soft landing).

UK inflation data was the final blow for BOE doves, with key headline figures rising above expectations. Core CPI rose 3.5% y/y (3.4% expected) and 0.2% m/m (0.1% expected), and the ever-elevated services PMI rose 0.6% m/m (0.4% expected) and remained at 5.7% for a second month.

Wall Street performed quite the divergence on Wednesday, with the Dow Jones reaching another record high for a third straight day yet the S&P 500 and Nasdaq 100 plunged lower. Bets of another Trump Presidency and the prospects of lower interest rates boosted the Dow to just below 42,500, yet a blue-chip selloff sent the ‘magnificent seven’ lower and weighted on the S&P 500 and Nasdaq accordingly.

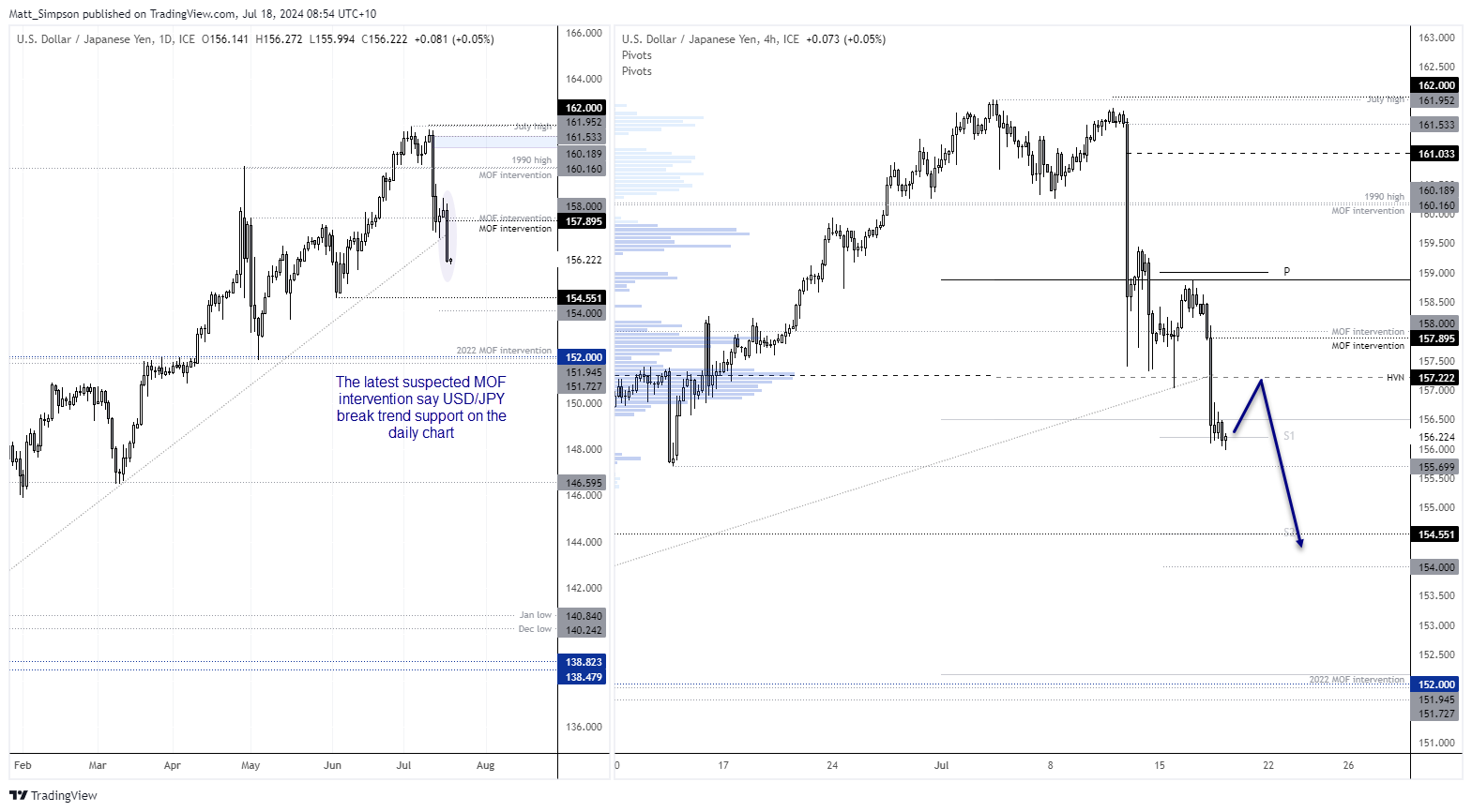

USD/JPY technical analysis:

The daily chart shows a clear break of trend support after the latest suspected MOF. And the 4-hour chart shows I am running out of space to label MOF intervention levels. Still, the MOF are clearly taking advantage of a weaker US dollar narrative, and with traders felling less compelled to fight the power that be, fading into rallies seems to be the most logical way forward (or lower, in this case).

USD/JPY has stabilising around the weekly S1 pivot, but bears could fade into bounces towards 157 / HVN in anticipation of a move towards the weekly S2 pivot (154.55) and the 154 handle.

US dollar index technical analysis:

We saw the countertrend bounce I had anticipated earlier in the week on the US dollar index. It just was not very impressive, before momentum turned lower once more. The futures contract for DXY formed a shooting star candle below the 100-day EMA on Tuesday before rolling over and closing firmly below the 200-day EMA on Wednesday. The move down to the June low has come a little earlier than expected.

Support was found around the weekly S1 pivot, and prices are now trapped between that and the 1-hour price of the 7 June NFP report. Given the bearish momentum on the 1-hour chart, bears may be tempted to fade into minor rallies and target the June low, just above the 103 handle. Although I would expect more of a reaction from such a level, given its significance. The daily RSI would have also likely reached its oversold zone by then as well.

Events in focus (AEDT):

Today’s busy calendar has Australia’s employment report in focus for RBA watchers. The key question here is if figures will remain robust as they have done this year, or heat up further to make things tricky for the RBA who have already discussed hiking rates over the past two meetings as domestic inflation is once again trending higher.

With an August cut for the BOE at a 50/50, a hot UK employment and wages report could kills such bets and send GBP/USD to a fresh 1-year high. The ECB are unlikely to signal any changes, let along make any. But it should still be on traders radars, just in case.

- 09:50 – JP trade balance

- 11:30 – AU employment, RBA bulletin

- 14:00 – UK employment, earnings

- 18:05 – BOE member Benjamin speaks

- 19:00 – EU construction output

- 22:15 – ECB interest rate decision (no change expected)

- 10:30 – EU jobless claims

- 10:30 – US Philly Fed manufacturing

- 10:45 – ECB press conference

- 12:15 – ECB Lagarde speaks

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge