Economic events (times in AEST)

We have no top-tier economic data in the APAC session. And as markets are really waiting for Jerome Powell’s testimony to the Senate Banking Committee, the real risk is no risk will be taken and volatility will be low. Still, Australia has consumer and business sentiment reports to kill time with. Neither of them have been particularly rosy lately, but then if things were that bad inflation would surely not be rising. Weaker business sentiment does not alone remove the risk of an RBA hike if, for whatever reason, consumers keep buying things to ush prices up.

The standout event over the next 24 hours is Jerome Powell’s testimony to the Senate. With a slew of key economic data points from the US turning south, even a slightly dovish speech could wreak havoc and send the US dollar and yields lower. It’s very unlikely he’ll deliver a hawkish spiel. The question is whether he’ll feed the doves.

- 10:30 – AU consumer sentiment (Westpac)

- 11:30 – AU business confidence (NAB)

- 20:00 – US small business optimism (NFIB)

- 21:00 – BOE quarterly bulletin

- 23:15 – US Fed Vice Chair for Supervision Barr speaks

- 00:00 – US Fed Chair Jerome Powell Testifies, Treasury Secretary Yellen Speaks

- 03:30 – FOMC member Bowman speaks

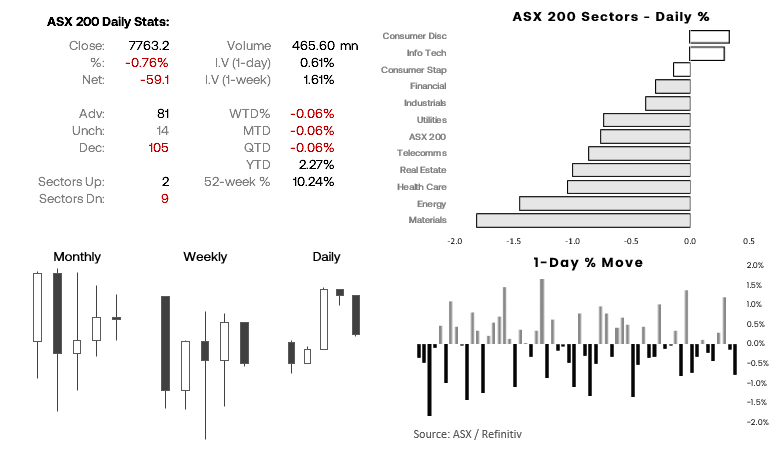

ASX 200 at a glance:

- The anticipated pullback from trend resistance has played out well

- However, the ASX 200 remains within a copy compression range – which is not kind to longer-term holds

- The ASX 200 cash index suffered its worst day in 10 on Monday

- 9 of the 11 ASX 200 sectors declined on Monday, led by materials and energy

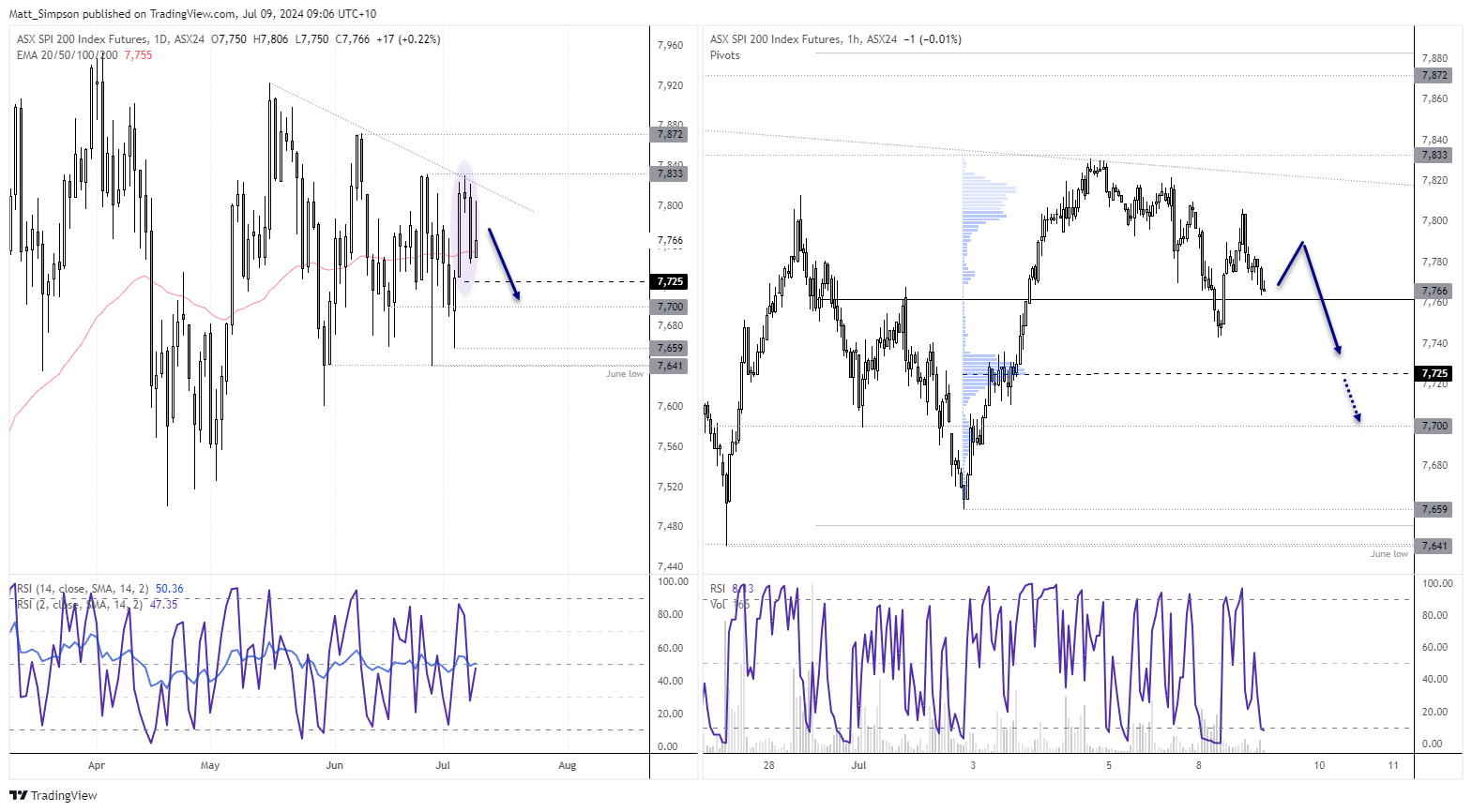

ASX 200 futures (SPI 200) technical analysis:

A 3-bar bearish reversal pattern called an evening star formation formed on Friday, which keeps the ASX 200 confined to its choppy range beneath trend resistance. And I see no immediate threat of it breaking out of range, which could make the ASX 200 more suited to intraday traders until sentiment changes. Prices are holding above the monthly pivot point for now, so perhaps it can bounce from current levels. But whilst it remains beneath trend resistance, any such bounces could be viewed as favourable for bears to fade into. 7725 and 7700 are the next downside targets.

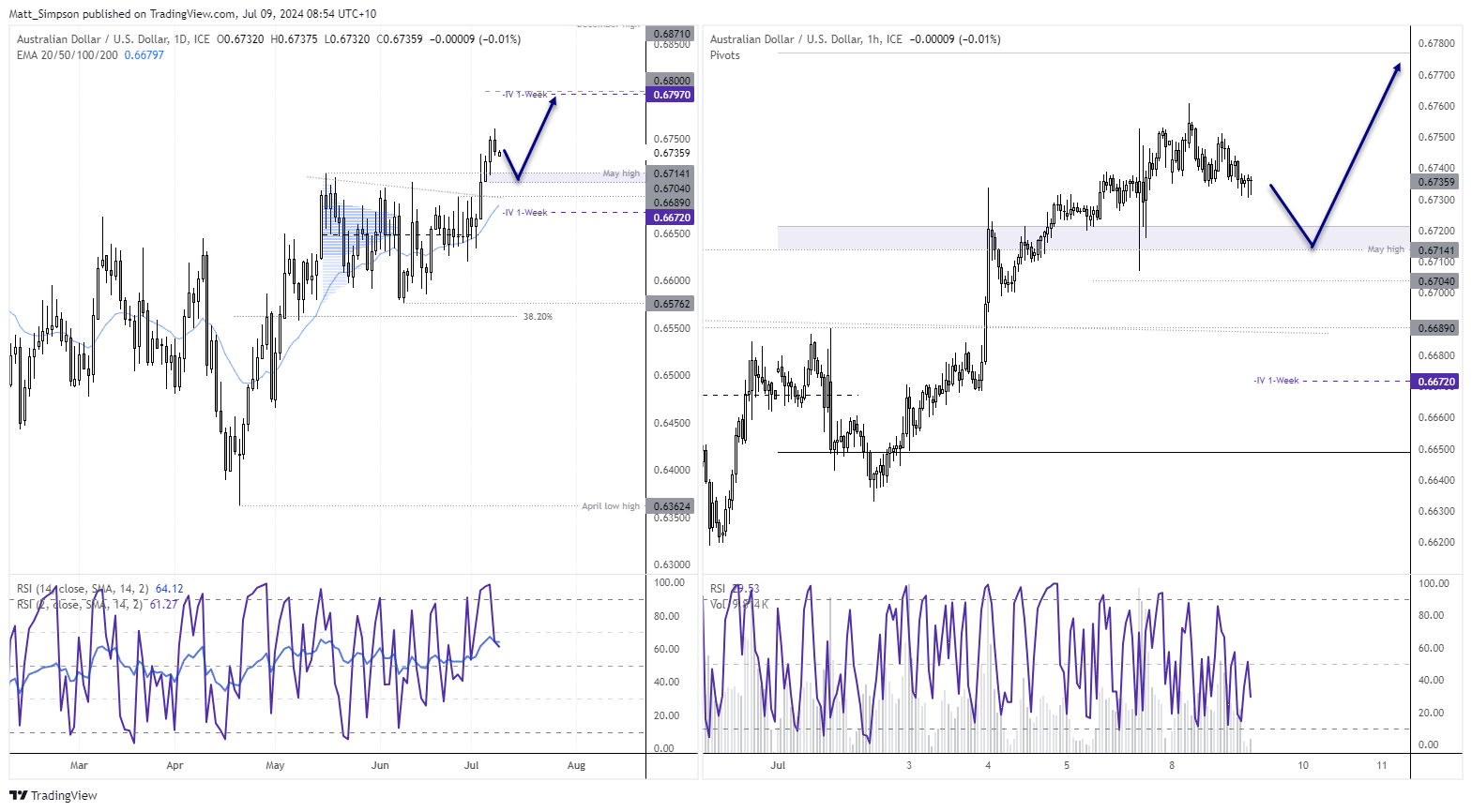

AUD/USD technical analysis:

The Australian dollar snapped a four-day winning streak on Monday. It performed an impressive breakout from its multi-week range last week, and a retracement from these levels is not necessarily a bad thing. AUD/USD could comfortably retrace to 76c without spoiling the bullish structure on the daily chart, although it may not need to retrace that far unless Jerome Powell surprises with a hawkish testimony later today.

Ultimately, AUD/USD remains on our bullish watchlist, so any dips to support levels could be viewed as favourable. 68c remains the next upside target.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge