US CPI needs to cool to keep the USD bear case in check: Week Ahead

At the time of writing the US dollar is on track to form a bullish inside week. This shows a slight hesitancy to simply continue last week’s selloff, but at the same time bulls are not exactly rushing to wade back into the dollar. We know further hikes are off of the table, ad that the US dollar will be susceptible to further selling should US data weaken – particularly if CPI data softens next week.

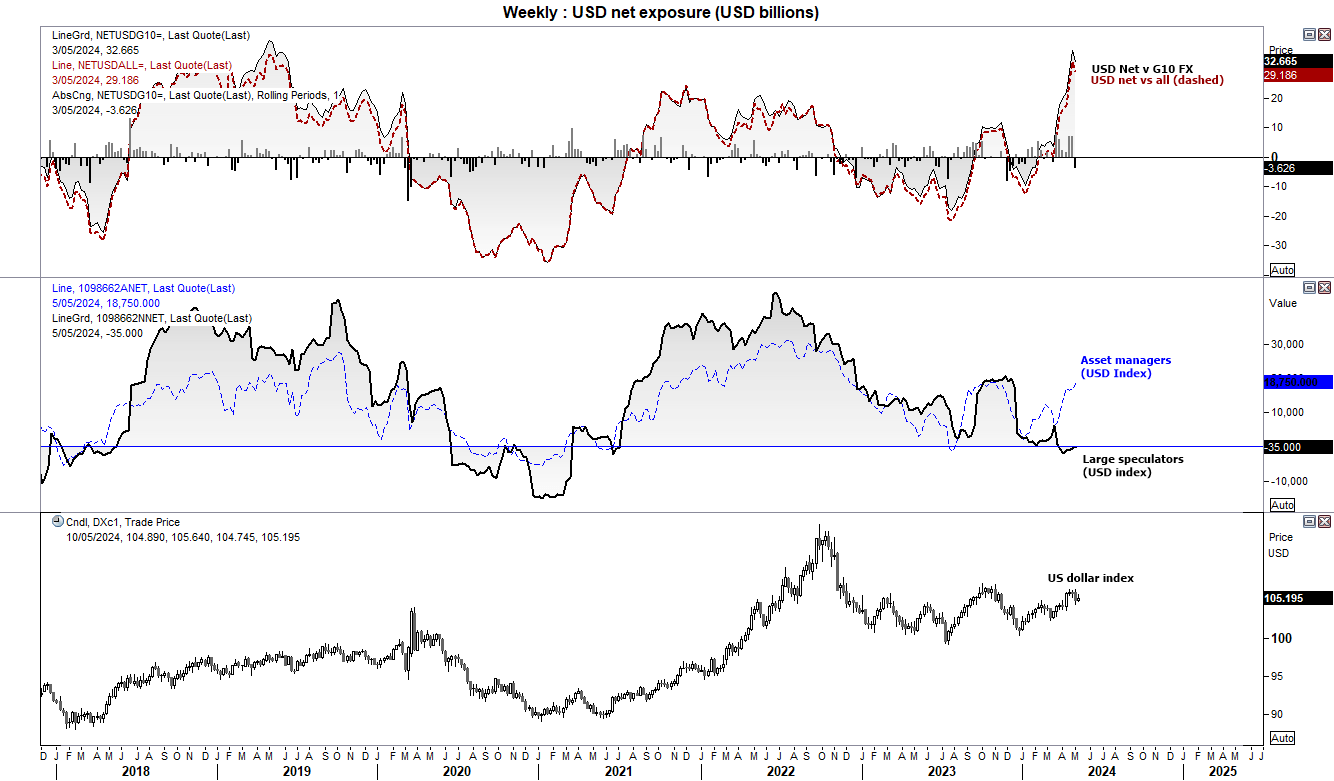

US dollar index, market positioning

Market positioning also raises a few questions. Last week net-long exposure to all FX futures contracts fell by -3.6 billion, which was its fastest weekly pace this year. Ad as net-long exposure was arguably at a sentiment extreme the week prior, I suspect we have indeed seen the top for the US dollar. If so, asset managers may need to reconsider their net-long exposure to the dollar index, and large speculators may already be considering expanding their net-short exposure. Of course, next week’s inflation report will be key for the dollar’s direction next week and beyond, as it really needs to soften to justify the bearish week made during NFP’s bearish engulfing week. And with a Jerome Powell speech on tap ahead of the CPI report, it is hard to imagine we’ll be looking at another inside day next week for the dollar.

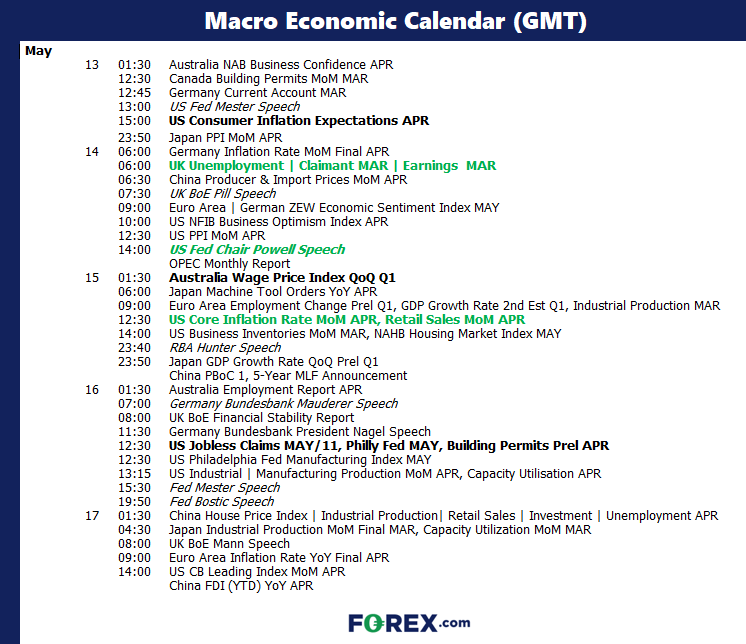

The week ahead (calendar):

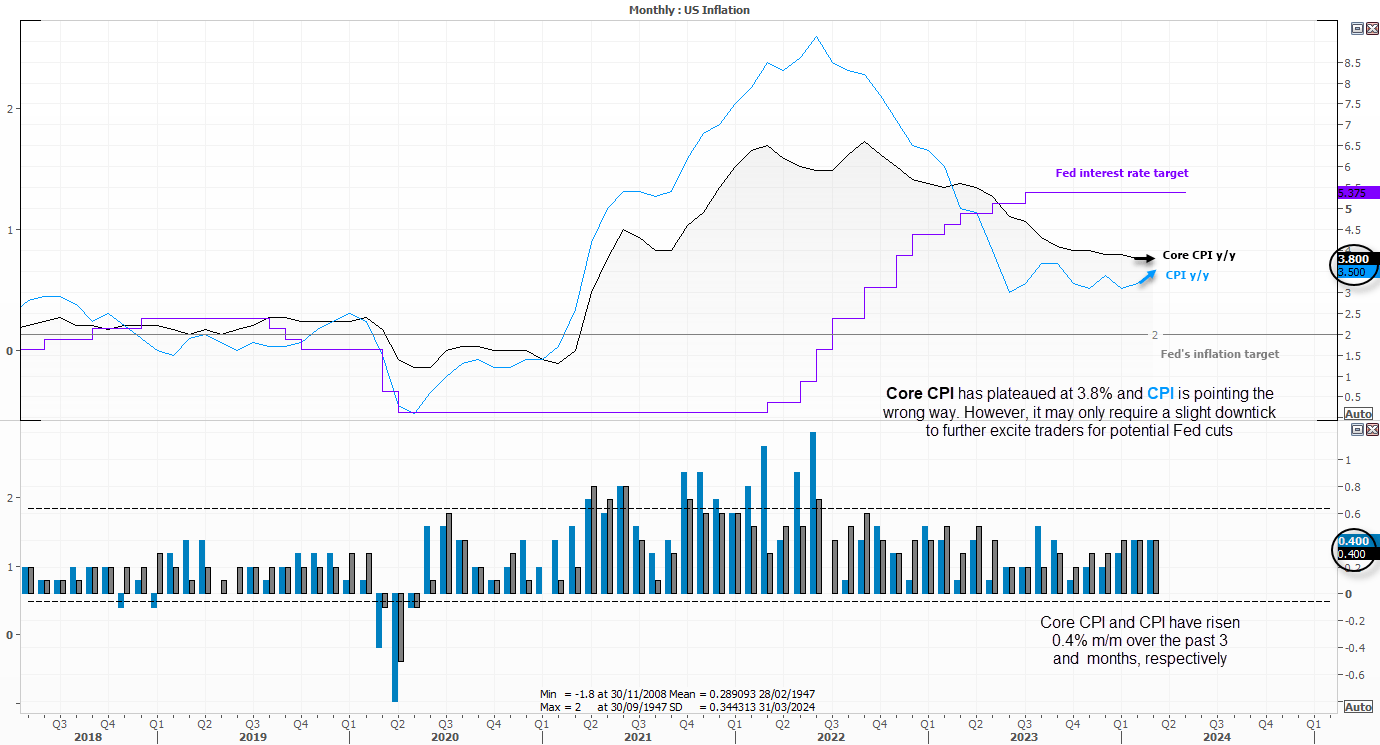

US inflation:

Traders are really honing in on any scraps of weak US data to justify their desires for Fed cuts. They pounced on higher jobless claims figures on Thursday, sending the US dollar lower against all of its forex major peers, excluding the Japanese yen. They were also quick to respond to the cooler NFP report last Friday which saw job growth slow to a 6-month low of 175k and unemployment rise to a 3.9%.

But are these figures really that bad? I guess it depends on what you want to see.

Unemployment has remained below 4% for 27 months and the US economy is still adding jobs in the 6-figure level. Not to mention that the prices paid component of US manufacturing is higher and of course the PCE inflation report just two weeks ago is also pointing the wrong way. And that takes us nicely to next week’s inflation report.

Core CPI has risen 0.4% m/m over the past three reports. For context, the long-term average is 0.29%. This has kept core CPI at 3.8% y/y for the past two months. For context, the Fed’s target is 2% - nearly half the current rate of inflation. Against that backdrop, 175k jobs added with a 3.9% unemployment rate doesn’t strike me as particularly deflationary. But again, traders are seeing what they want and honing in any nougat of weakness to justify their sacred cuts.

But if this is how markets are responding, it would be foolish to ignore. And that means bearish USD bets may be the way forward (or down) upon even the slightest whiff of economic weakness in the US. So I can only imagine the excitement for Wall Street should core CPI drop to 3.7% and come in at just 0.3% m/m.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

Jerome Powell speech

However, on the eve of the US inflation report we have Jerome Powell scheduled to speak with ECB hawk Klass Knot. The two will speak in a ‘moderated’ discussion at the Annual General Meeting of the Foreign Bankers Association. This leaves the potential for some spicy comments to be made ahead of the key US inflation report, and that volatility heading into the two events could also be limited – with the potential to be revived during Tuesday’s speech and of course Wednesday’s inflation print.

The speech can be watched live here: https://www.youtube.com/@foreignbankers

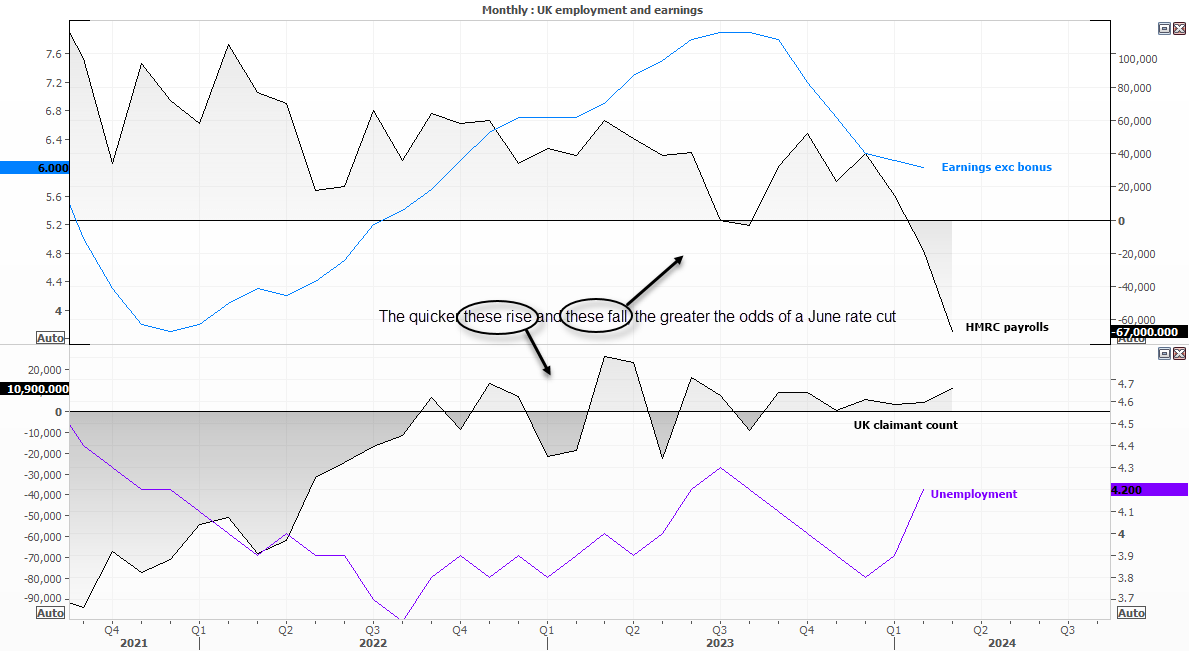

UK employment, wages

The BOE are laying the groundwork for a potential cut in August or even as soon as June. Yet for either to happen, we really need to see earnings data and employment figures continue to cool – with the severity of any weakness adding to pressures for the BOE to cut in June and weigh on GBP accordingly.

We saw MPC votes to cut rise to 2 (from one) and hold fall to 7 (from 8), which shows appetite to ease is slowly on the rise. But with members undecided just how much quickly easing can begin, there may be too many sat on the fence to assume June is a slam dunk unless next week’s data really comes off. And at the very least, that could limit downside potential for GBP pairs if not see the pound rise should data turn higher.

Take note that BOE chief economist Phil Hew speaks at 07:30 GMT on Tuesday, on the economic outlook for the UK.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge