- New Zealand inflation undershot expectation in Q3

- NZD/USD on track for a re-test of Friday’s lows

- Kiwibank forecasts the RBNZ rate cuts in the first half of 2024

New Zealand inflationary pressures moderated-more-than expected in the September quarter, taking the wind out of the NZD/USD’s sails following the expected election victory from the National Party-led coalition over the weekend.

New Zealand inflation strong but it could have been worse

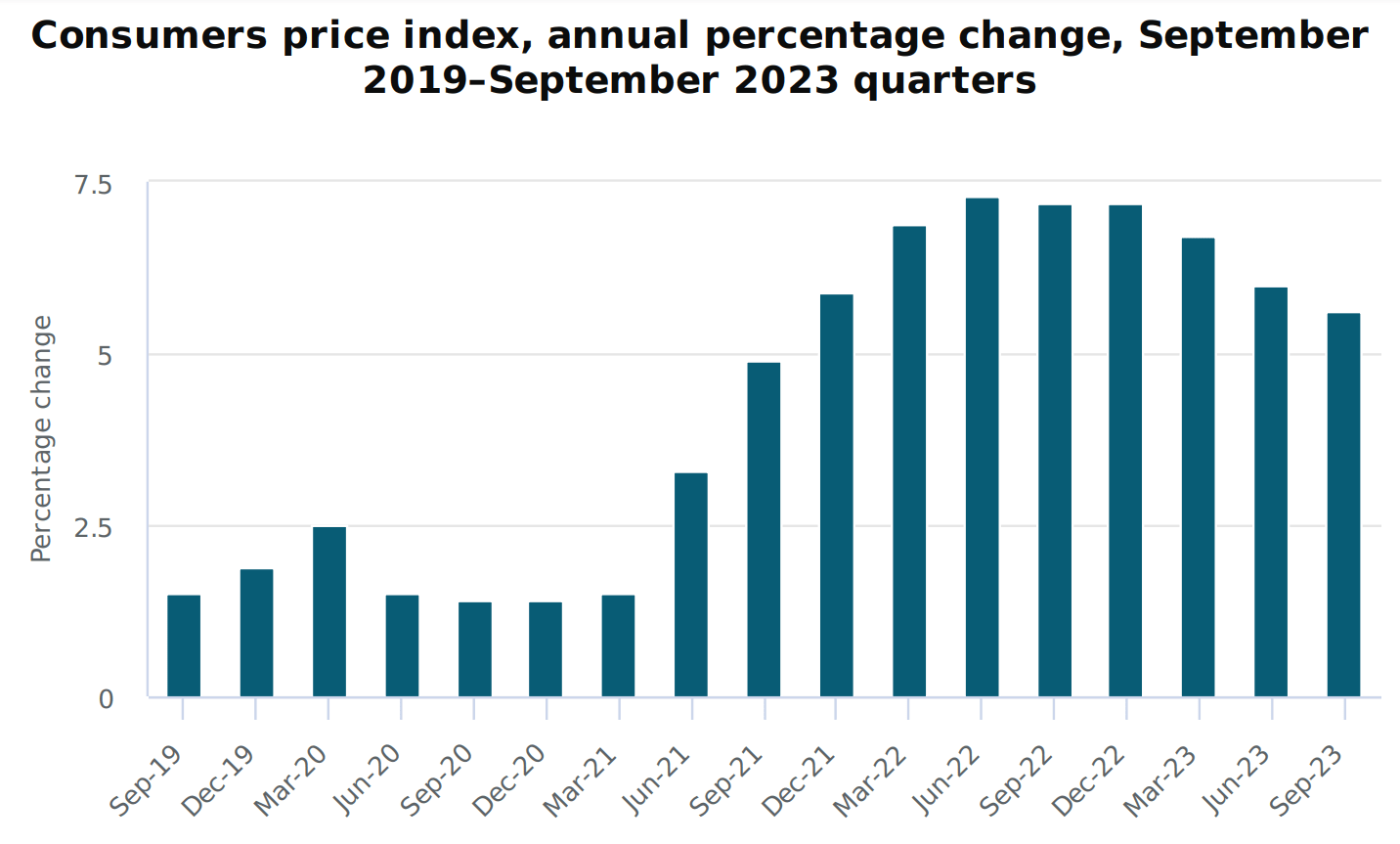

Headline consumer price inflation (CPI) rose 1.8% in the September quarter, down two-tenths on expectation, seeing the annual rate slow to 5.6%. Non-tradable prices – typically reflecting domestic factors – rose 1.7% for the quarter, a tenth slower than the 1.8% increase reported for tradable items. Of more importance to the RBNZ interest rate outlook, StatsNZ said its underlying “trimmed mean” inflation measures rose between 5.5% to 5.7% from a year earlier.

Source: StatsNZ

While still well above the 2% midpoint of the RBNZ’s 1-3% inflation target, Kiwibank chief economist said the data suggests the risks of another rate hike from the RNBZ has been greatly diminished.

“Whatever probably there was before today’s numbers, it’s closer to zero now,” he said. “The rates market had the probability of an RBNZ rate hike in November at 50% leading into today’s report. The terminal rate implied in the wholesale market was 5.72% - so nearly a full 25bp hike priced by April next year.

“We should see a reduction in rate hike expectations. We continue to call the peak in the cash rate at the current 5.5%. And we go one step further in suggesting rate cuts may become likely by May next year.”

While the undershoot in headline CPI has generated a reasonable downside reaction in NZD/USD, traders should be aware that the RBNZ sectoral factor inflation model – which policymakers watch closely for clues on the trajectory for underlying inflationary pressures, will be released early afternoon in Wellington.

It can and has delivered large movements in the NZD/USD previously, holding the power to shift the prevailing narrative generated by the official inflation report.

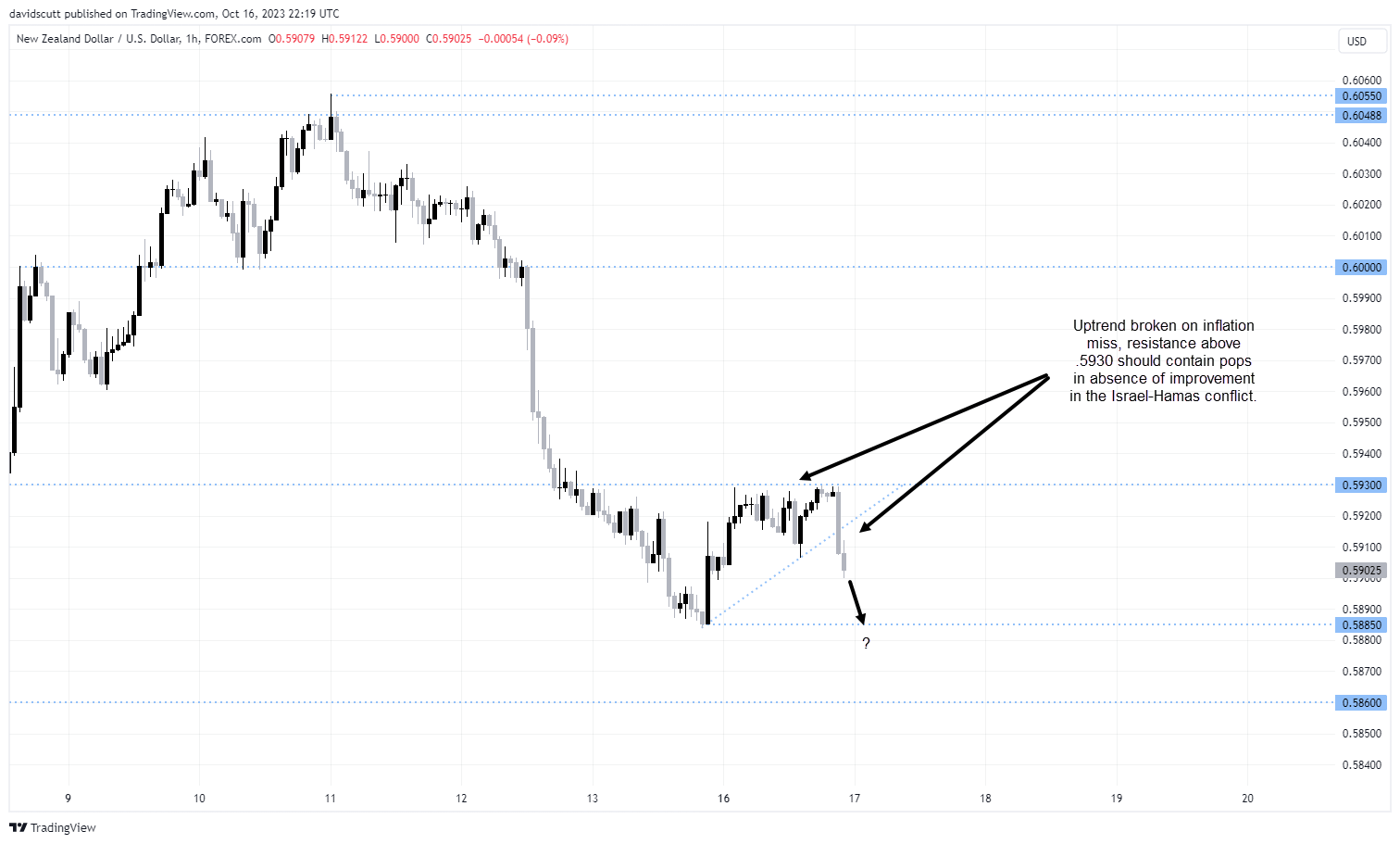

NZD/USD breaks uptrend, eyes downside support

Looking at NZD/USD on the hourly chart, it has broken the uptrend from the lows struck late last week, suggesting a re-test of support located at .5885 could be on the cards. Below that, .5860 would be the next downside target. Bounces towards .5930 are likely to be repelled near-term in the absence of an unlikely improvement in the macroeconomic environment.

-- Written by David Scutt

Follow David on Twitter @scutty