- RBA leaves Australia’s cash rate unchanged at 4.35%, as expected

- Remains prepared to “do what is necessary” to bring inflation back to its 2.5% target

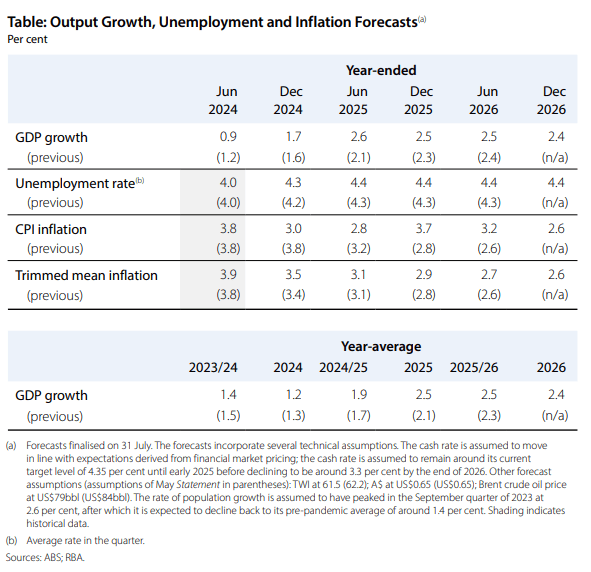

- Latest forecasts have higher underlying inflation, stronger growth

- Forecasts are underpinned by an assumption the cash rate will decline to 3.3% by the end of 2026

No dovish pivot from the RBA

The Reserve Bank of Australia (RBA) refrained from delivering a dovish pivot following its August monetary policy meeting, acknowledging that while the economic outlook remains highly uncertain, inflation remains above target and is proving persistent. The cash rate was left unchanged at 4.35%, as expected by most economists and traders.

The biggest question was whether the slight undershoot in the trimmed mean inflation reading relative to market forecasters in the June quarter would be enough to see the RBA to soften the tone regarding the inflation outlook. The answer was a definitive no.

“Inflation in underlying terms remains too high, and the latest projections show that it will be some time yet before inflation is sustainably in the target range,” the board said. “Data have reinforced the need to remain vigilant to upside risks to inflation and the Board is not ruling anything in or out. Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range.”

Importantly, it left the final line of the statement unchanged, repeating it “remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome”. The retention of the "do what is necessary” section is important as this has only appeared in statements in which the RBA has been particularly concerned about the inflation trajectory.

Another interesting development was the focus on developments in underlying inflation measures, rather than volatile headline inflation series that can be influenced by one-off factors such as government energy rebates. It’s obvious the RBA’s is putting emphasis on underlying inflation trends.

Limited focus on international developments, for now

On developments in the global economy and markets, the board were surprisingly succinct, downgrading its assessment towards the Chinese economy while only acknowledging recent moves from central banks and markets.

“There also remains a high level of uncertainty about the overseas outlook,” it said. “The outlook for the Chinese economy has softened and this has been reflected in commodity prices.” Previously, the RBA suggested the outlook for the Chinese economy had improved.

It also noted that some central banks had eased policy but “remained alert to the risk of persistent inflation”. It also added that financial markets had been “volatile of late” while the Australian dollar had “depreciated”.

RBA sees inflation remaining higher for longer

Being a quarterly meeting, the RBA released its updated economic forecasts in the accompanying statement on monetary policy. Looking through the detail, the important trimmed mean inflation forecasts offered few surprises with the year-ended rate remaining above the 2.5% midpoint of the bank’s 2-3% inflation target out to the middle of 2026.

Source: RBA

The nearer-term profile was nudged up a tenth of a percent to reflect the modest upside surprise to its forecasts in Q2 and a far more dovish cash rate profile that has it falling to 3.3% by the end of 2026. That can be read as an assessment that less restrictive settings are unlikely to result in an earlier return to target.

Its GDP growth forecasts were nudged up a touch across the profile while unemployment is seen rising to 4.3% by the end of this year before topping out at 4.4% next year.

The initial kneejerk reaction from markets to no meaningful dovish shift from the RBA faded quickly in the Australian dollar and rates markets, reflecting not only a lack of surprise in most forecast items but also that it’s offshore factors that are far more likely to influence what the RBA does next, rather than the domestic economy.

But in the absence of a deterioration abroad, the key message is the board remains in no rush to cut rates. Something for markets to ponder given more than one 25 basis point rate cut remains priced in by the end of 2024.

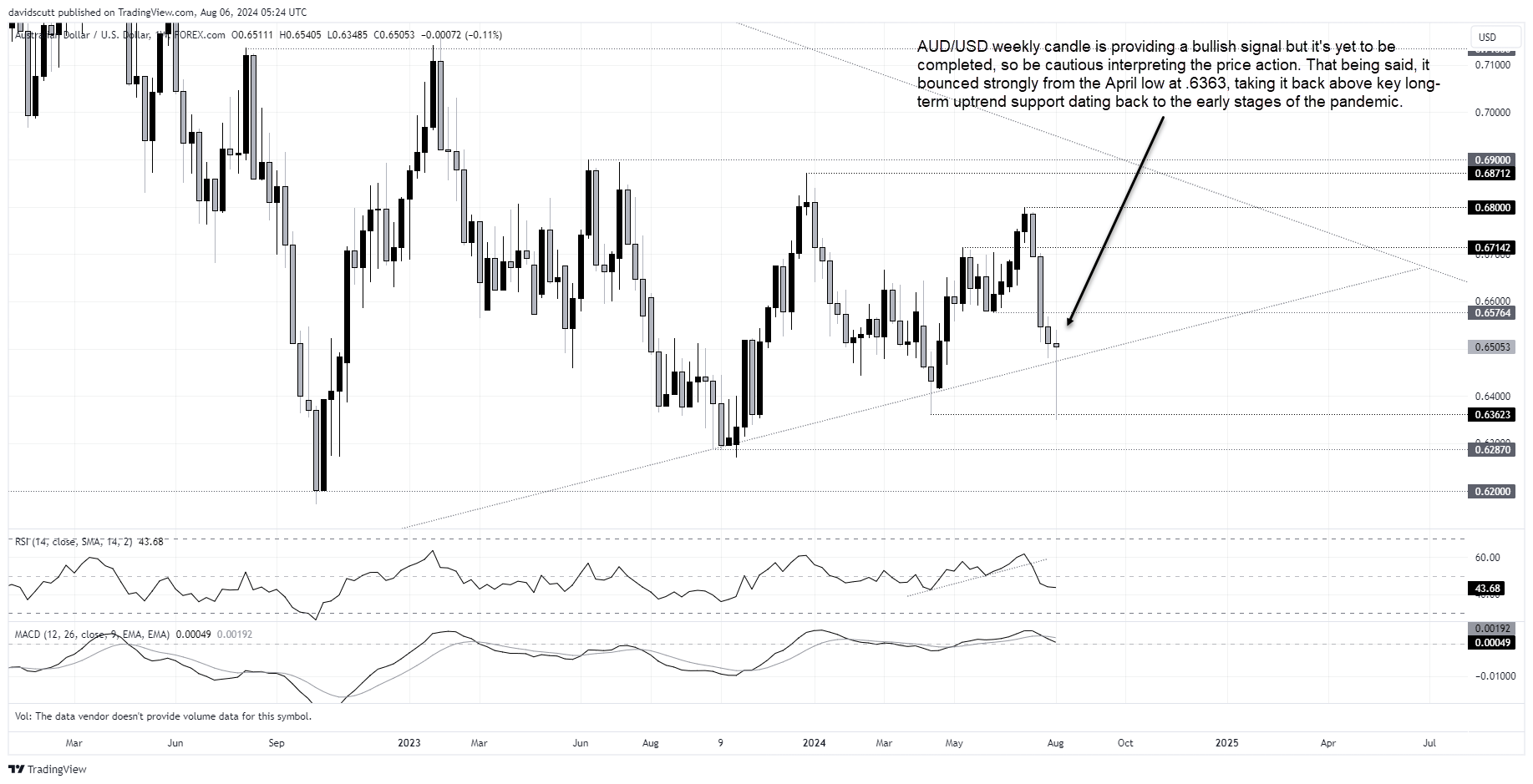

AUD/USD stages impressive rebound

Looking at AUD/USD, the current weekly candle is providing a bullish signal but it yet to be completed, so be cautious interpreting the price action. But the bounce after testing the April lows was impressive, taking the Aussie back above the uptrend it’s been in since the lows of the pandemic. .6576 is the first topside level of note with .67142 the next after that.

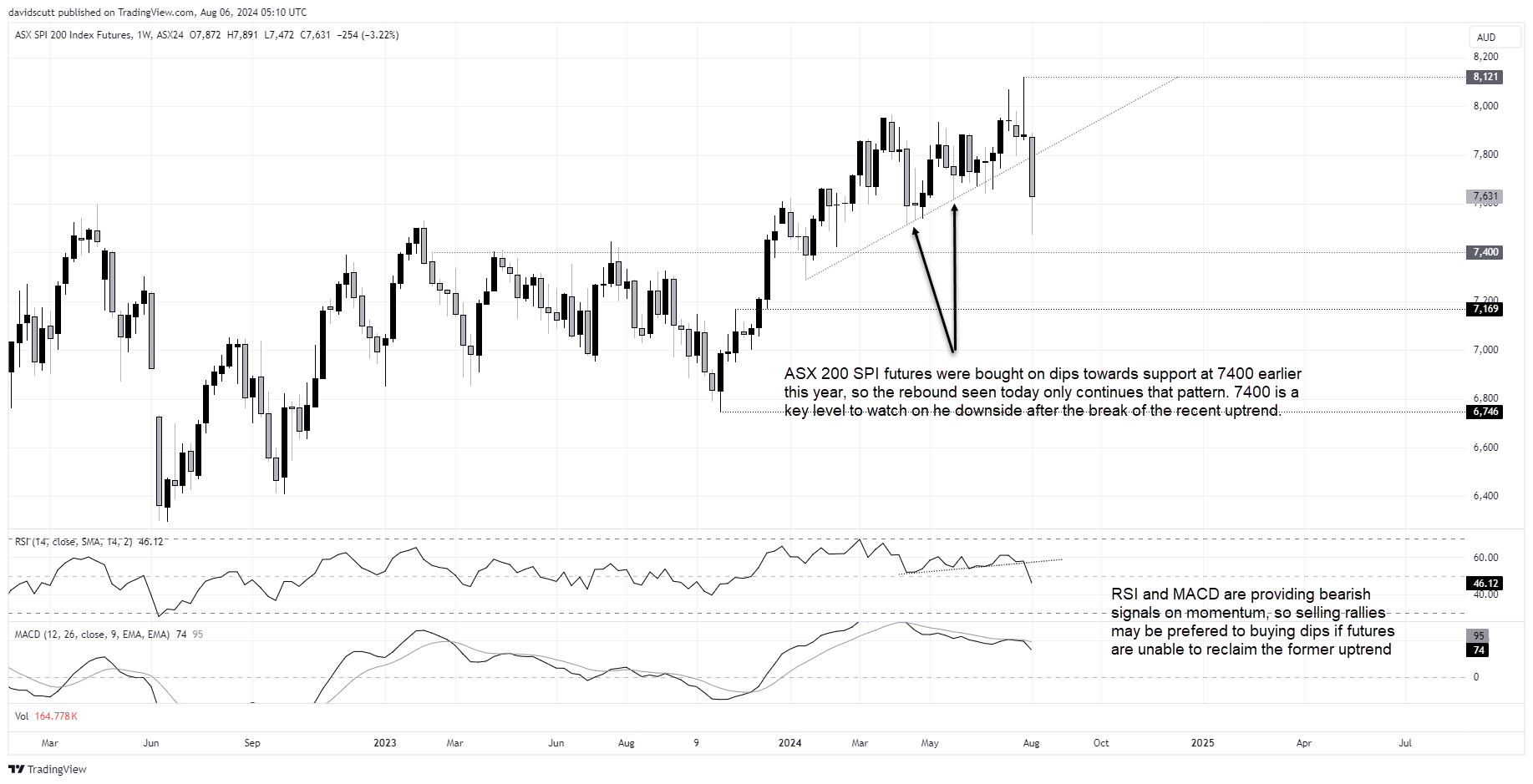

ASX 200 SPI futures break uptrend, sell on rallies now?

If there’s been a trend of late for ASX 200 SPI futures, it’s that dip-buying has emerged on pullbacks towards support at 7400. While the price has rebounded off the lows, whether it remains that way is questionable with momentum indicators generating bearish signals. The price has also broken the uptrend it has been in since the start of the year, raising questions as to whether selling rallies may now be preferred to buying dips?

-- Written by David Scutt

Follow David on Twitter @scutty