When gold falls during a time of turbulence, you know you’re in trouble. And that is exactly what we saw on Wednesday alongside the rise of longer-term yields, as investors switched to cash and presumably offloaded gold to nurse stock market losses.

I noted several key risk markets which were approaching key support levels in today’s articles. Since then we have seen Nikkei futures extend losses to fresh 5-week low, although it is trying to hold above the June low. AUD/JPY is now beneath the 100 handle, March 2023 trendline and teetering on the edge of a break of the May low. Copper has edged lower, but remains above $4 – a level I suspect will hold for now.

Related analysis:

Nasdaq pullback reaches crossroad, ASX 200 bulls eye sympathy bounce

AUD/USD slammed, JPY thrives amid Wall Street selloff, BOJ expectations

Gold was overbought weeks ago, according to this measure

And that brings me to gold. Whilst gold has been under pressure over the past two days, there surely comes a point where dip buyers may want to seek the safety of the precious metal. And I suspect we’re very close to that point.

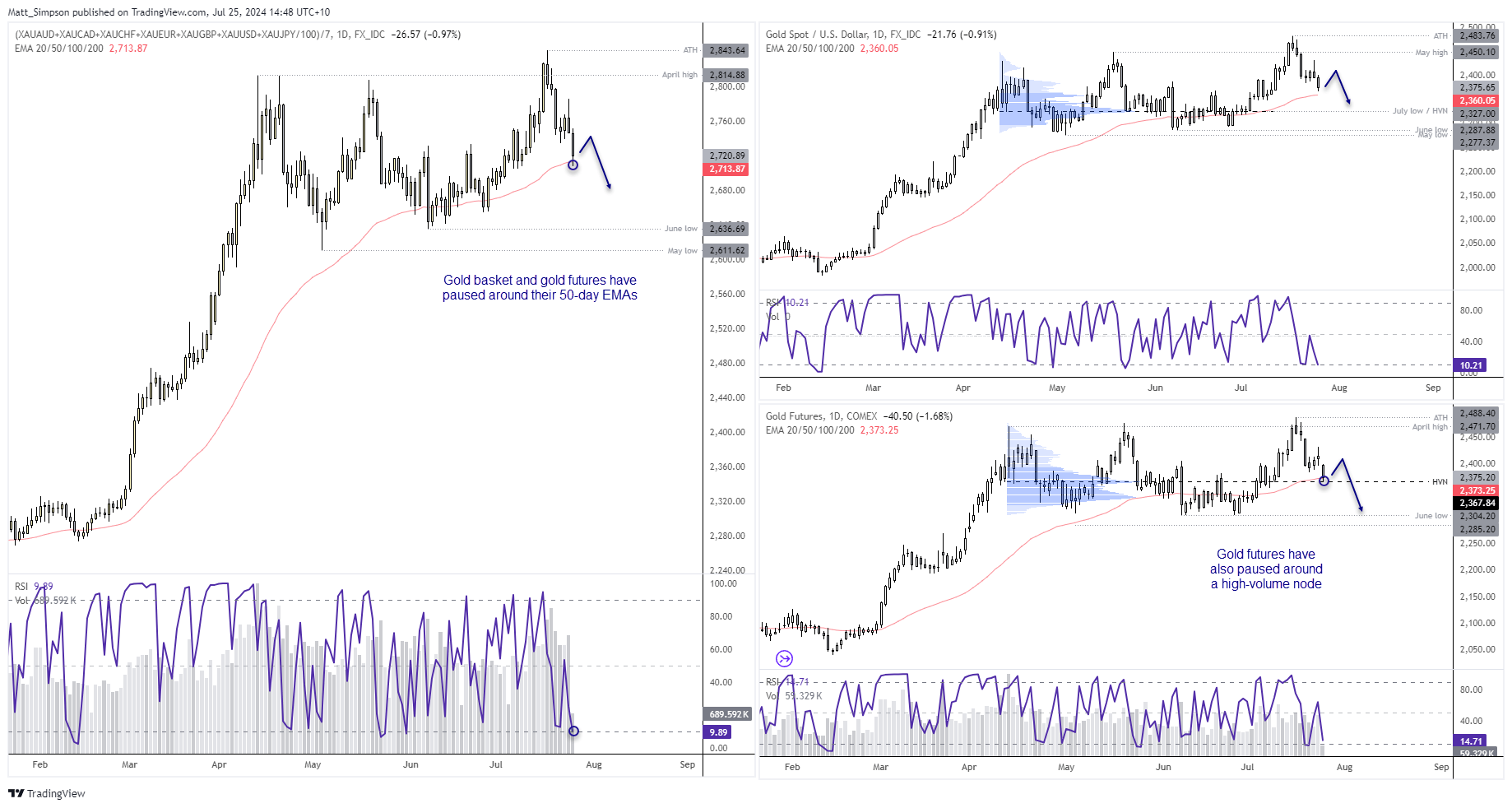

This daily chart compares an equally-weighted gold basket to spot and gold futures. The fact the gold basket is falling alongside XAU/USD tells us that broad gold weakness is the cause of gold’s decline as opposed to simply US dollar strength. There are subtle but important differences between the structure of spot and gold which may help us navigate its twists and turns.

Gold futures have found support around the 50-day EMA and high-volume node (HVN) of the prior consolidation. The gold basket has also found support at its 50-day EMA and its daily RSI (2) is dipped into oversold, although the day is yet to close. Spot gold’s RSI is close to reaching oversold. Sure, there may be some wriggle room for fresh lows over the next 24 hours, but I suspect ti could be due a bounce ahead of its next leg lower.

Besides, gold saw a decent bearish pinbar at its record highs and this week’s selloff is likely a much-needed correction against a strong bull market, which allows for further downside whilst retaining its potential for new record highs in the coming months.

Gold technical analysis:

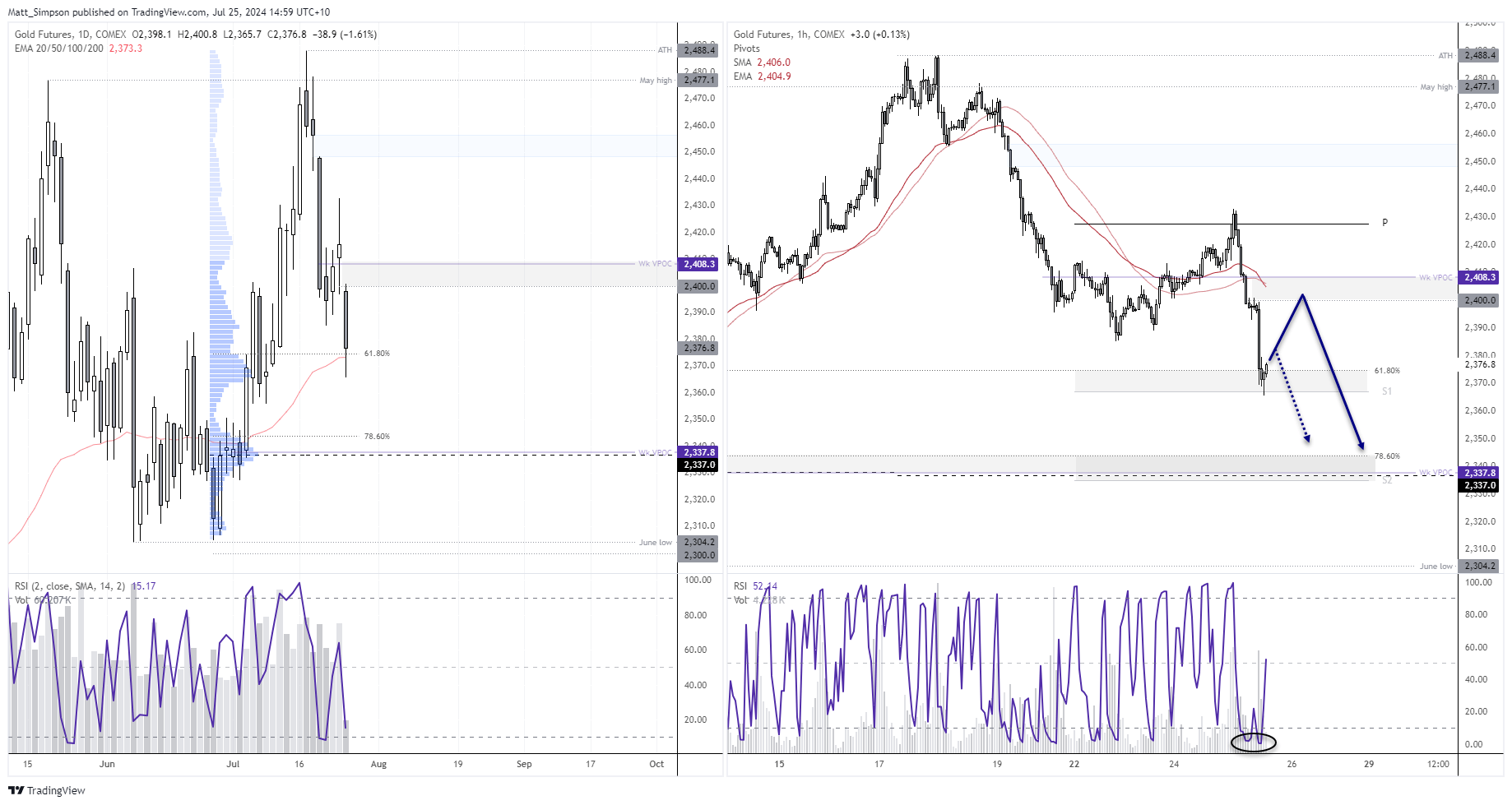

The 1-hour chart shows a strong drop to the weekly S1 pivot (2367). RSI (2) reached oversold twice, and a small bullish hammer suggests it is trying to form a base. Low volatility dips towards the weekly S1 could appeal to bullish swing trades. Of course, high volatility moves lower assume the bears have taken back control.

For now, the bias is for a move towards 2390 or 2400, as which point we can reassess its potential for a swing high and next anticipated leg lower.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge