Today’s release of the ISM services PMI helped to soothe investor nerves slightly after recession fears and unwinding of carry trades had caused a big slump in risk assets and USD/JPY earlier in the day, trigging sharp moves in other FX markets too. At the time of writing, the major indices had bounced off their lows but still remained deep in the red. Stock market investors will continue to monitor FX and bond markets for direction. With the dollar starting to ease against some of the other major currencies, perhaps this could help take attention away from the plunging USD/JPY. Still, for the major indices a bullish reversal candle is now needed to confirm the market has formed at least a temporary low before dip buyers can confidently exert the same sort of pressure on the markets that had been evident in the first half of the year. Meanwhile, the EUR/USD earlier was up at 1.10 to test its best levels since January, before dipping on the back of the ISM data. Still, in light of the big drop in the dollar index and expectations of a sharp pivot by the Fed, the EUR/USD forecast will remain positive.

EUR/USD forecast boosted by carry trade unwind

Primarily due to the unwinding of carry trades, we have seen a big plunge in risk assets over the last few trading days, with the selling gathering pace overnight before the services PMI data helped soothe concerns somewhat. A big feature of the gains in risk assets in the first half of the year involved what we call a carry trade. This involves borrowing money at low-interest rates (for example in Japan) and investing it in higher-yielding assets (for example US technology stocks or Treasuries). This strategy is popular in forex trading, where investors exploit low-interest rates and weaker currencies in one country to reinvest in another with higher returns. But right now, we are seeing the opposite of that trade, after Japan surprised investors with a bigger rate hike last week than expected. Meanwhile, the US dollar lost some of its yield advantage as weaker macro data raised recession alarm bells, and thereby a sharp repricing in US interest rates expectations. On balance, this is also helping the EUR/USD given prior expectations that the Fed will cut rates at a slower pace then the ECB, even if the latter has already started cutting.

While the gains in the EUR/USD appear limited for the time being, I reckon once the equity markets stabilise, we might see the single currency and other major currencies gaining strength against the dollar more profoundly. For, the greenback has lost some of its yield advantage after Friday's disappointing US jobs report and a series of weak economic indicators suggesting an imminent recession. For now, the euro is the only currency showing resilience, apart from those with lower interest rates like the yen, franc, and the Chinese renminbi.

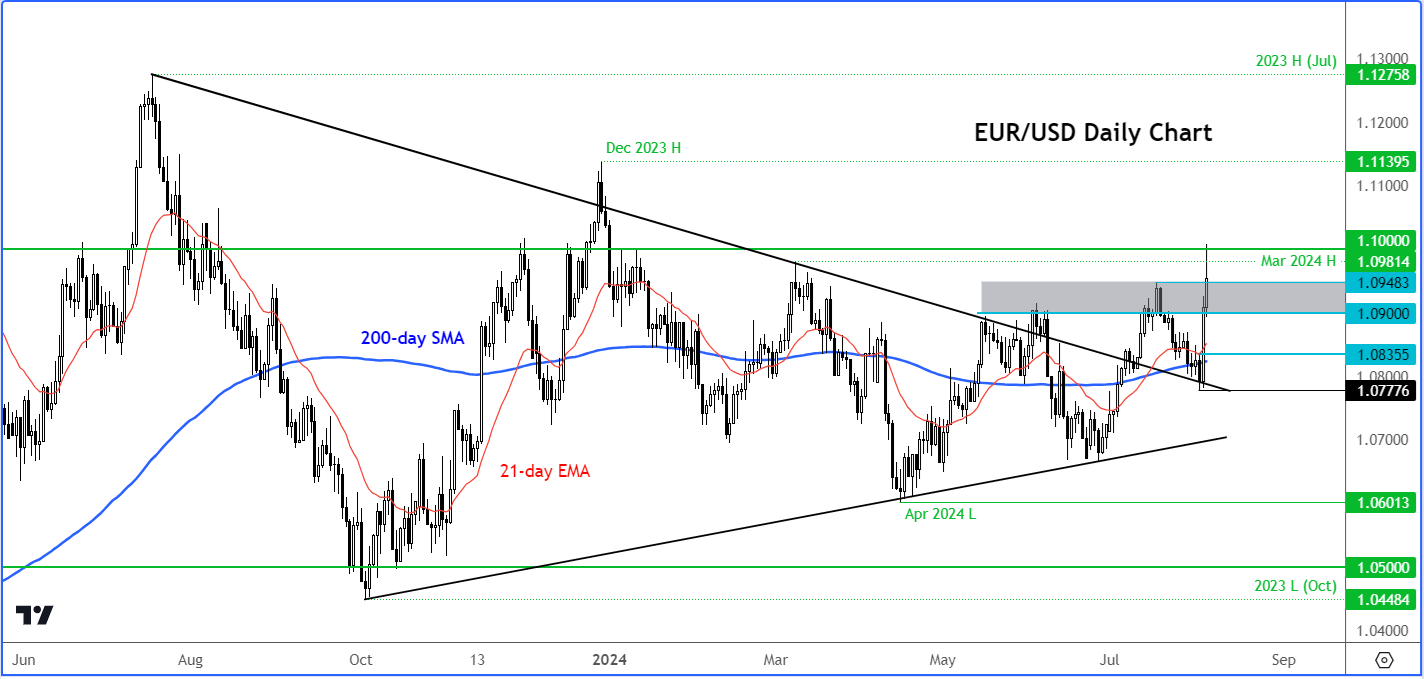

EUR/USD technical analysis

Source: TradingView.com

The technical forecast on the EUR/USD remains bullish ever since it broke above its bearish trend line that had been in place since last July. Consequently, we will be looking for dips back to any of the short-term support level such as 1.0950, 1.0900 and perhaps even 1.0835 to hold and provide a bounce. On the upside, resistance at 1.1000 has already been tested today and so far, it has held firm. A break above it could pave the way for a run towards the prior highs of 1.1140 (Dec) and 1.1275 (last July).

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R