The EUR/USD has been on the rise in the last few days, nearing its highest levels since March after breaking above the 1.0900 handle. The rebound is primarily attributed to a weakening US dollar, despite mixed economic data from the United States. As market participants await the European Central Bank rate decision, the weaker US dollar is keeping rates supported. Influencing the EUR/USD outlook this week would be any hints of rate cuts, or lack thereof, by the ECB come Thursday.

Key Influences on EUR/USD

Trend of US economic data has been negative

Recent US economic indicators have presented a mixed picture. Headline retail sales data came in flat albeit still higher than expected, and core sales surprisingly rose 0.4%, while the Empire State Manufacturing Index fell short of forecasts. These mixed signals have maintained market expectations of a potential Federal Reserve rate cut in September, especially following the weaker-than-expected Consumer Price Index data last week. The speculation around the Fed's monetary policy has put pressure on the US dollar not just against the euro but other major currencies too, as well as precious metals, with gold hitting yet another record high.

ECB policy decision coming up but no cuts expected

The European Central Bank's upcoming policy decision could turn out to be an important event for the EUR/USD pair. While no rate cuts are expected this time, the ECB's stance and any forward guidance will be closely scrutinised. The previous rate cut in June was driven by concerns over economic growth and as inflation showed weakening signs.

Christine Lagarde has emphasised the ECB's data-dependent stance and has avoided committing to a specific rate path. Eurozone headline inflation remains above ECB’s 2% target, at 2.5%, with the core measure today confirmed at 2.9% in June. The ECB is expected to monitor inflation trends closely, with CPI likely to approach the 2% target in the third quarter. This scenario could pave the way for additional rate cuts later in the year. We think two more cuts could be on the way.

Although the ECB is likely to adopt a wait-and-see approach at this meeting, the more stable political outlook in Europe and recent weakness in US economic data support a stronger EUR/USD exchange rate. I think a revisit of 1.10 handle is now likely.

Economic Calendar Highlights for EUR/USD

Aside from industrial production and a few other macroeconomic indicators, the US economic calendar is relatively quiet for the remainder of the week. The same would apply to Europe’s data calendar if not for the ECB policy decision on Thursday. Here are this week’s key macro highlights relevant to the EUR/USD pair:

This week, the Empire State Manufacturing Index has posted a lower-than-expected reading of -6.6, maintaining pressure on the US dollar despite stronger retail sales. Next up, we will see data on building permits and industrial production before attention shifts to the ECB meeting on Thursday, alongside the release of US jobless claims and the Philly Fed Manufacturing Index.

EUR/USD outlook: Technical Analysis and Trade Ideas

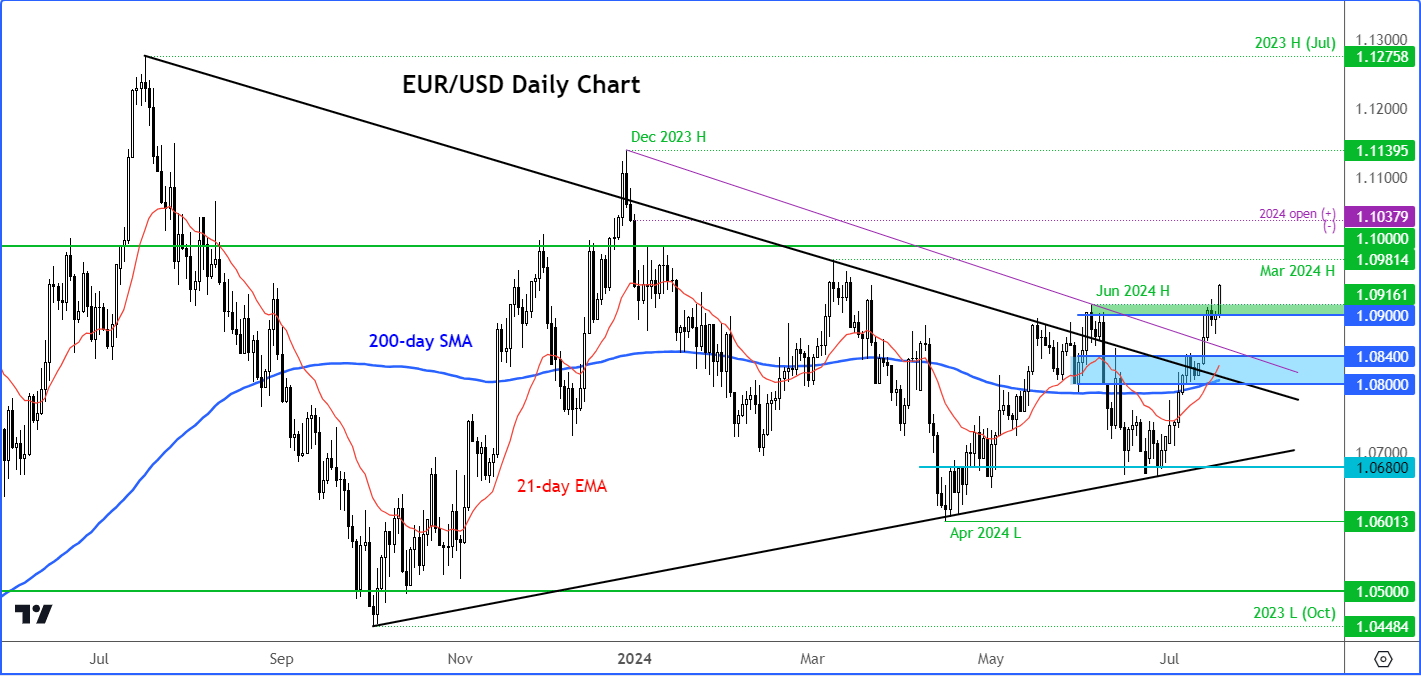

Source: TradingView.com

From a technical perspective, EUR/USD has broken above key bearish trend lines from July and December last year. The pair is also trading above its 21-day exponential moving average and 200-day simple moving average, indicating a bullish technical outlook.

Key short-term support levels are seen around the 1.0900-1.0915 area, followed by 1.0840 and 1.0800, where the 200-day average currently resides. On the upside, the 1.10 level is the next obvious target, but the potential is there for the EUR/USD to climb a lot higher in light of the technical developments this week.

So, the EUR/USD outlook remains positive ahead of the ECB rate decision, supported by recent soft patch in US economic data and technical breakout. While no immediate rate cuts are expected from the ECB, the central bank's guidance and future policy direction will be crucial for the euro's performance. Traders should monitor key support and resistance levels and be prepared for potential volatility surrounding the ECB's announcement and subsequent press conference.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R