- EURUSD Outlook: EURUSD opened nearly 30 points down with the latest French election results.

- A potential Fed rate cut, driven by declining CPI figures, could further boost EURUSD.

- EURUSD vs DXY Analysis

Latest French election results

• Far Left: 182 seats

• Centrist: 163 seats

• Far Right: 143 seats

The far left's policies could negatively impact the 5.5% budget deficit, as it includes rolling back pension funds, increasing minimum wage levels, and controlling the price of consumer staples. Despite gaining significant seats, the far left is still short of an absolute majority, leading to a hung parliament. To prevent the far right from gaining control, an alliance between Macron’s party and the far left has formed, creating an uncertain but more favorable situation for French voters compared to a far-right government.

EURUSD Market Insights:

Political and Economic Atmosphere: The uncertainty in the French political scene caused a bearish open for EURUSD, dropping 30 pips before attempting to recover last week’s highs.

US Dollar Weakness: The US dollar is facing weakness amid rate cut bets, with attention on this week’s CPI indicator for signs of further inflation cooling.

Rate Cut Probabilities: Market participants are ready to increase the probabilities of a September rate cut if the CPI data aligns with expectations. Fed Chair Powell’s recent statement emphasized waiting for more disinflationary data before deciding on rate cuts. Powell’s testimony this week on the semi-annual monetary policy report could provide more clarity on the Fed’s policy direction.

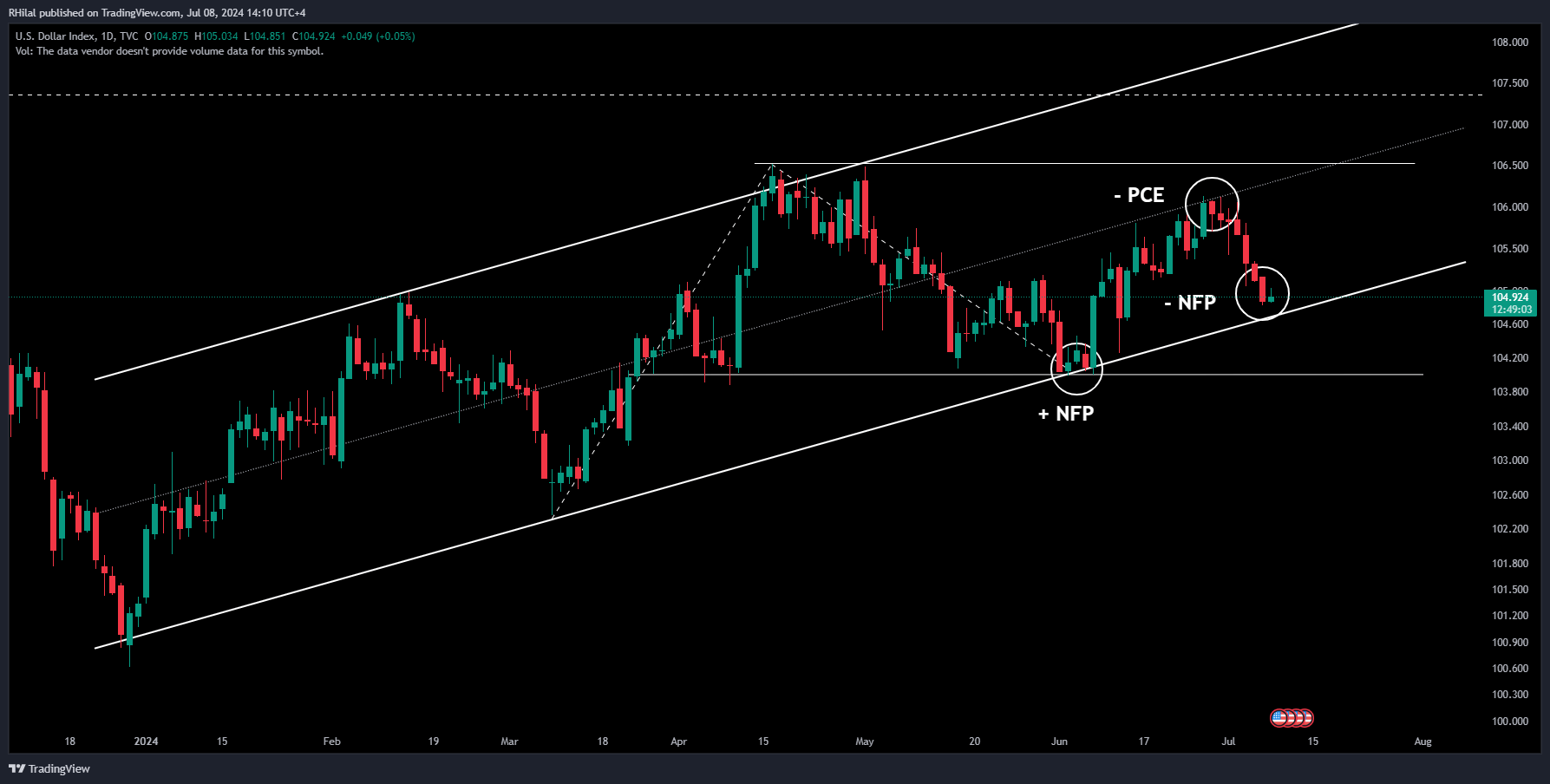

EURUSD Outlook: DXY – Daily Time Frame

Source: Trading view

Tracking the U.S. Dollar index within its adjusted yearly channel, declining U.S. indicators have pushed the index to the lower end. Indecision is evident in the current price action, and the June CPI figures, due on Thursday, are highly anticipated.

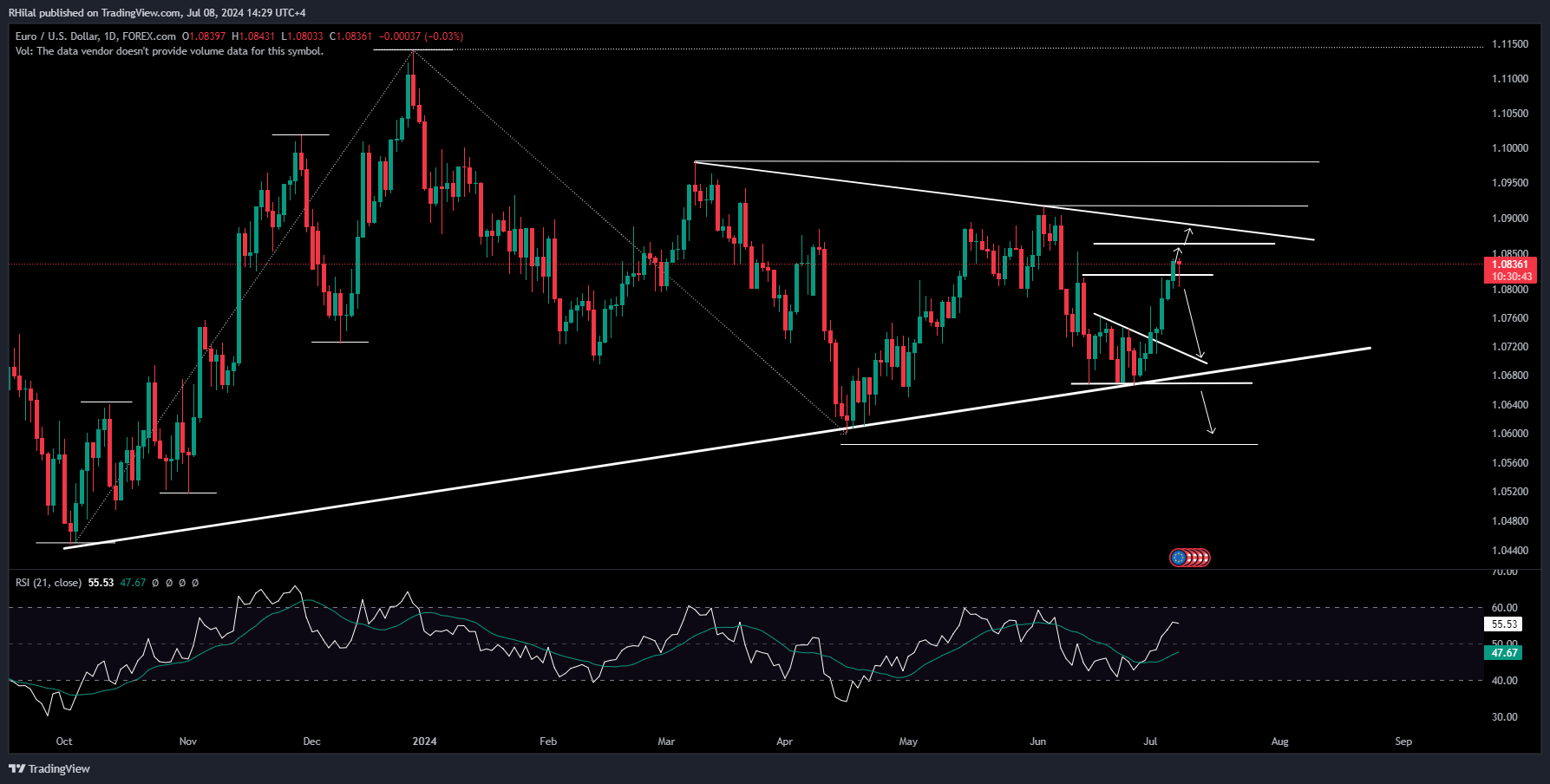

EURUSD Outlook: Daily Time Frame – Logarithmic scale

Source: Tradingview

The consolidating price action on EURUSD suggests that Fed rate cut bets could push the pair to retest potential levels at 1.0860, 1.09 -1.0920, and possibly 1.0980. Conversely, surprising inflation metrics could reverse the bullish trend, driving the pair back down to the previously respected lows of 1.07 – 1.0667.

--- Written by Razan Hilal, CMT