- EURUSD is trading back above 1.0820

- U.S CPI m/m dropped to 0.0%

- U.S CPI Y/Y and core CPI ticked 0.1% lower

- FOMC Projections and Statement ahead

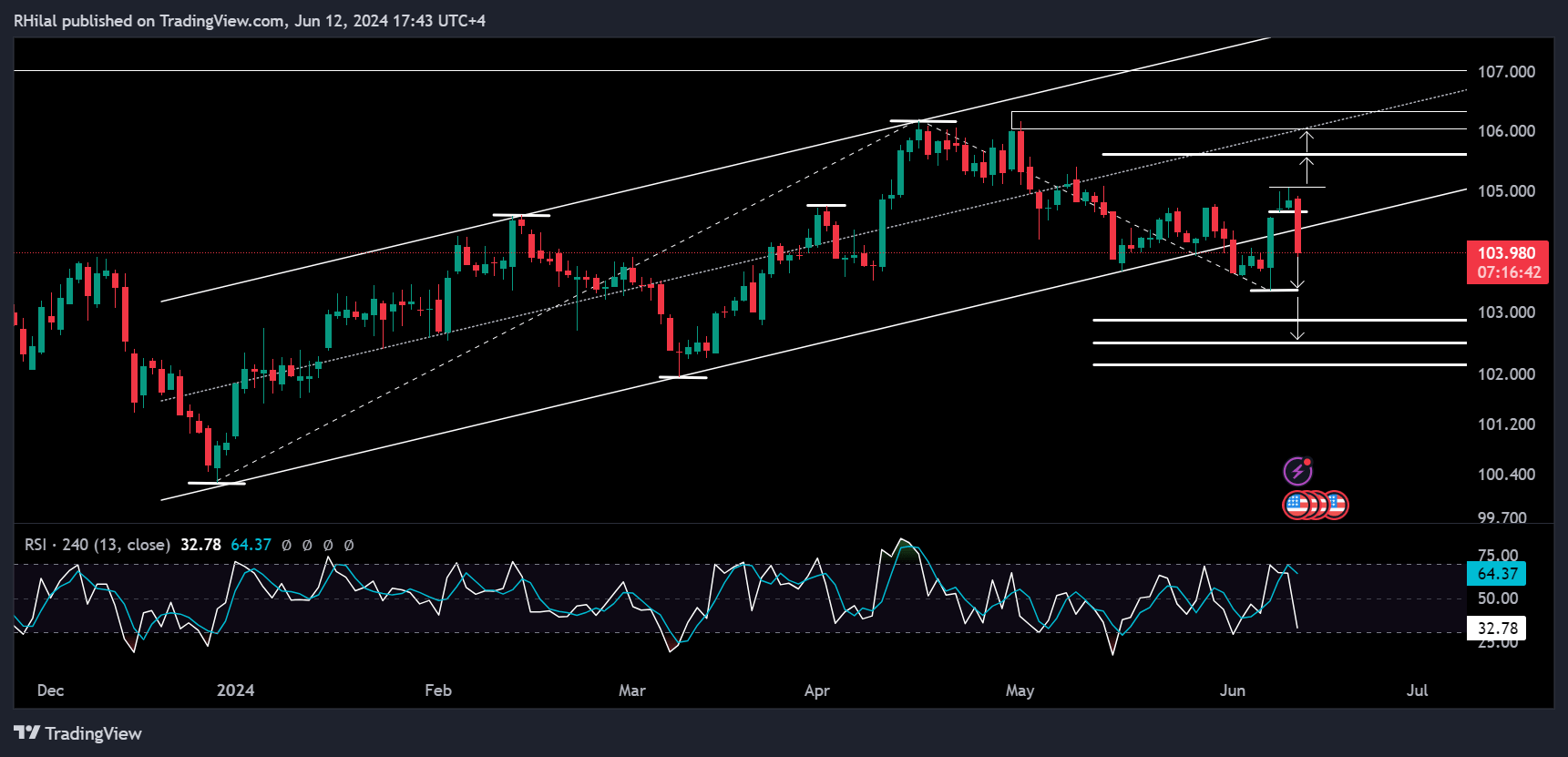

U.S Dollar Index Chart: Daily Time Frame – Logarithmic Scale

Following the bullish surge driven by positive NFP results, the DXY neared the 150-resistance level. However, negative CPI results have pushed it back down. The market is riding a wave of euphoria, fueled by hopes of near-term rate cuts.

Currently, the DXY's downtrend is erasing the gains from the non-farm payrolls, leading the 4-hour relative strength index back toward oversold levels, and the price back below the yearly up trending channel.

With the Fed rate decision and outlook next, a hawkish projection could trigger a market reversal while a dovish sentiment could sustain the current trends.

What does that mean for the EURUSD?

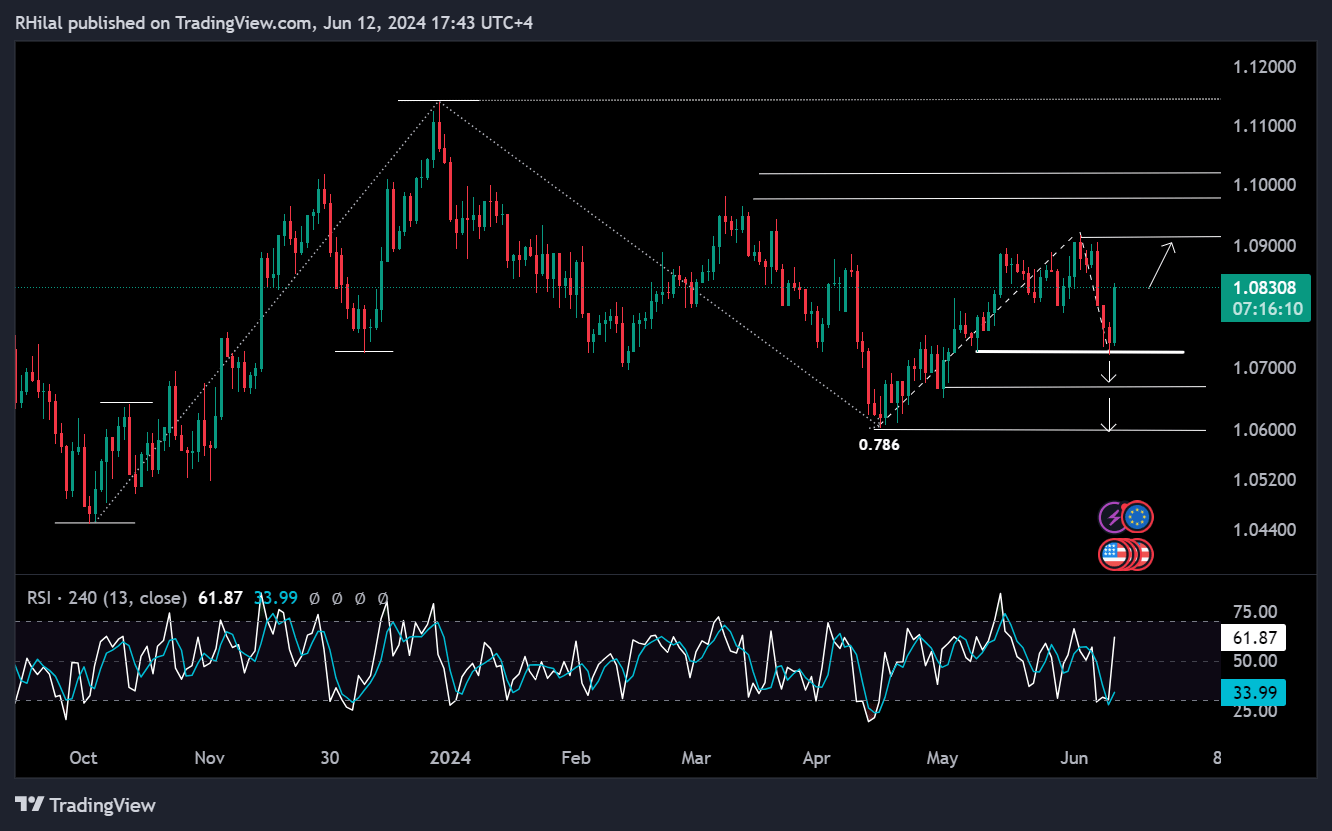

EURUSD Forecast: Daily Time Frame – Logarithmic Scale

In contrast to the DXY analysis, EURUSD has climbed back above the key 1.0820 level. A further break above 1.0840 could pave the way towards 1.0915 and 1.0950 consecutively. All eyes are now on the upcoming Fed statement and projections, which will provide clarity on the timing of the next potential rate cut.

Despite a slight downtick in the CPI y/y, recent data including the 9-month high ISM services PMI and positive non-farm payrolls suggest that a hawkish stance might still be possible.

In terms of the EURUSD chart:

- Dovish Fed Sentiment: If confirmed, EURUSD could soar above 1.1, targeting the 1.1020 level.

- Hawkish Fed Sentiment: Could drag EURUSD back towards the daily low at 1.0720, with further downward moves potentially reaching 1.066 and 1.06.

--- Written by Razan Hilal, CMT