- GBPUSD falls below 4-month trendline

- US Dollar Index rebounds from one-year trendline

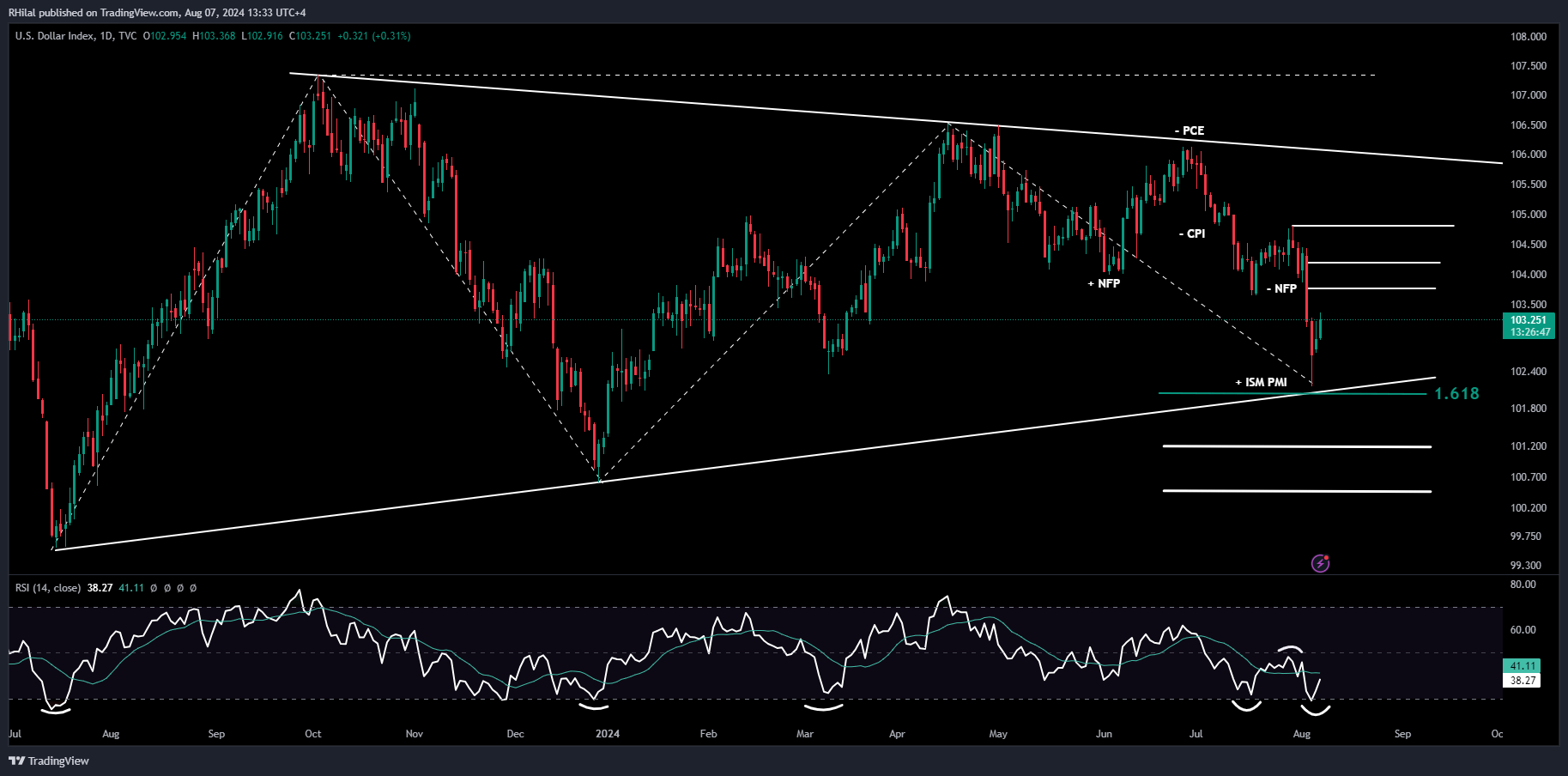

GBPUSD Outlook: DXY – Daily Time Frame – Log Scale

Source: Tradingview

The US Dollar index, consolidating since July 2023, rebounded following a higher-than-expected ISM Services PMI result and a retest of its more than one-year trendline. While the broader market, including stocks and commodities, shows a similar positive rebound, currencies are experiencing a bearish correction against the Dollar.

Two significant factors influencing the US Dollar trend, which can impact broader markets, are its role as a safe haven amid US recession fears and escalating geopolitical tensions, and the anticipation of a sooner-than-expected and greater-than-expected rate cut.

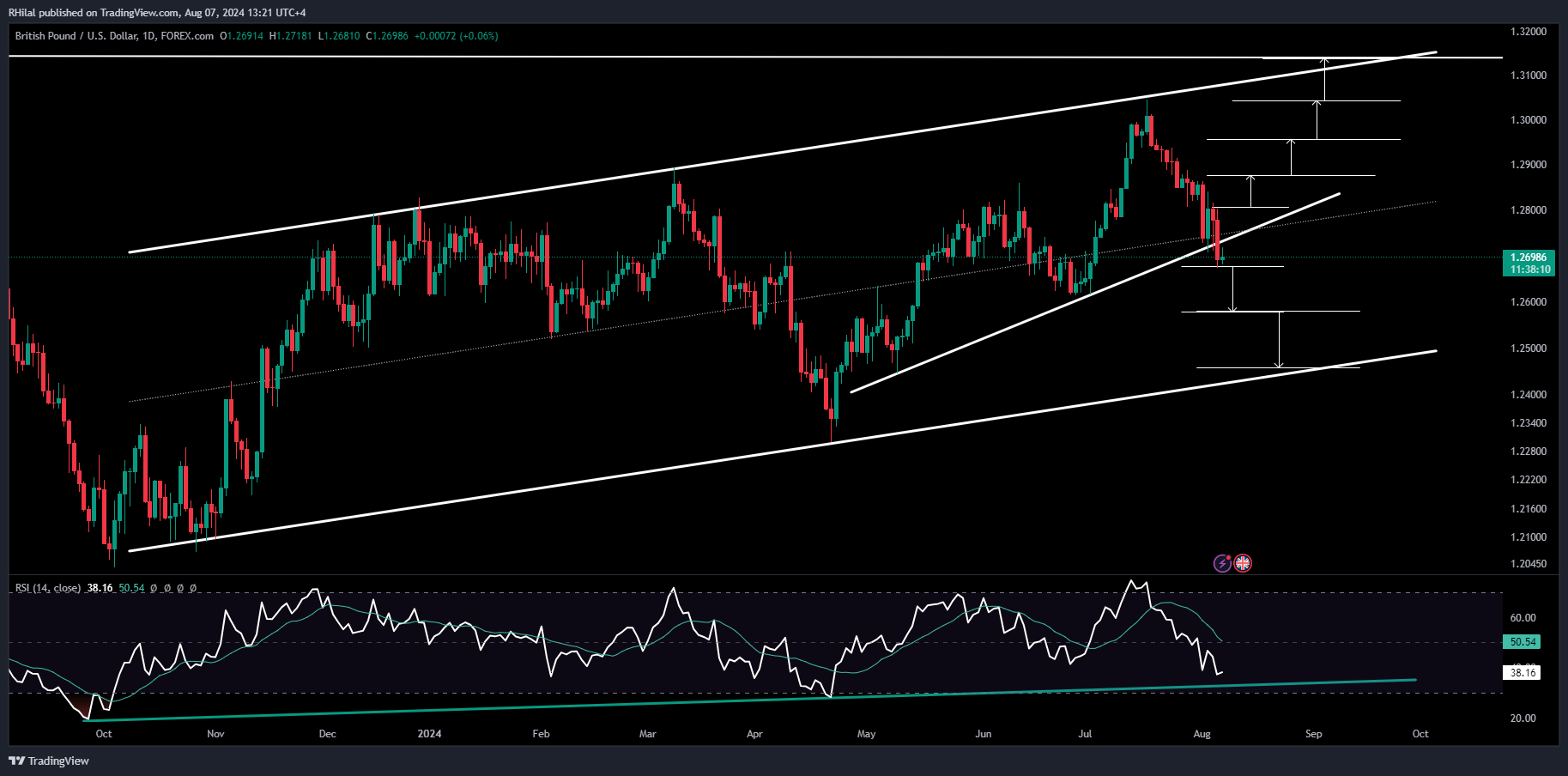

GBPUSD Outlook: GBPUSD – Daily Time Frame – Log Scale

Source: Tradingview

Breaking below its 4-month uptrend, the GBPUSD is now facing the trendline connecting the lows of October 2023 and August 2024. If it drops below its latest support at 1.2670, the GBPUSD is expected to encounter support levels at 1.2580 and 1.2460.

A turnaround from the current support could see a retest of the 4-month trendline border at 1.28. Further climbs above 1.2880 can revive the bullish trend, aiming for 1.2950, 1.3040, and 1.3140 respectively.

With respect to the momentum indicator, the Relative Strength Index (RSI), further drops are possible before the bearish momentum is exhausted in the oversold zone.

--- Written by Razan Hilal, CMT