US futures

Dow future 0.01% at 39336

S&P futures 0.17% at 5581

Nasdaq futures 0.25% at 20492

In Europe

FTSE -0.45% at 8158

Dax -0.97% at 18315

- Stocks at record highs ahead of Powell

- Powell testifies before Congress in a bi-annual event

- AI-related stocks continue to rise

- Oil falls as supply worries ease

Stocks rise ahead of Powell’s bis-annual testimony

U.S. stocks point to a higher start as the market looks cautiously ahead to testimony from Federal Reserve Chair Jerome Powell.

The NASDAQ and the S&P 500 reached record highs in the previous session as investors became increasingly convinced that the Fed will start cutting interest rates as soon as September. These two indices extend those gains today, and the Dow Jones is lagging.

Federal Reserve chair Jerome Powell will begin his two-day testimony before Congress with the Senate today, followed by the House on Wednesday.

The market will be watching to see if Powell offers more clues on monetary policy. Any dovish signals, particularly after a series of softer-than-expected data in recent weeks, could fuel rate-cut bets.

Unemployment has risen to the highest level since 2021, and the ISM services PMI is at a four-year low. Should Powell acknowledge that weakness is seeping through the economy, then Fed rate cut expectations could rise, lifting stocks.

Powell’s comments come ahead of the CPI data on Thursday, which is expected to show inflation, which is called 3.1% down from 3.3%.

The market is currently pricing in over a 75% probability of a 25 basis point rate cut in September, which is up from 56% last week.

In addition to the Fed and inflation, investors will also start looking toward the Q2 earning season, which kicks up on Friday with the banks.

Corporate news

Intel is set to extend gains after rising 6% in the previous session. Nvidia is also pointing to a stronger open as stocks with links to AI continue to be in demand.

Eli Lilly is expected to open higher, while Novo Nordisk is falling 1.8% after data showed that Eli Lilly’s weight loss drug Mounjaro leads to faster and greater weight loss than Novo’s Wegovy drug.

BP is falling over 4% after the energy giant warned that its second-quarter results would be hit by lower refining margins and an impairment charge of up to $2 billion.

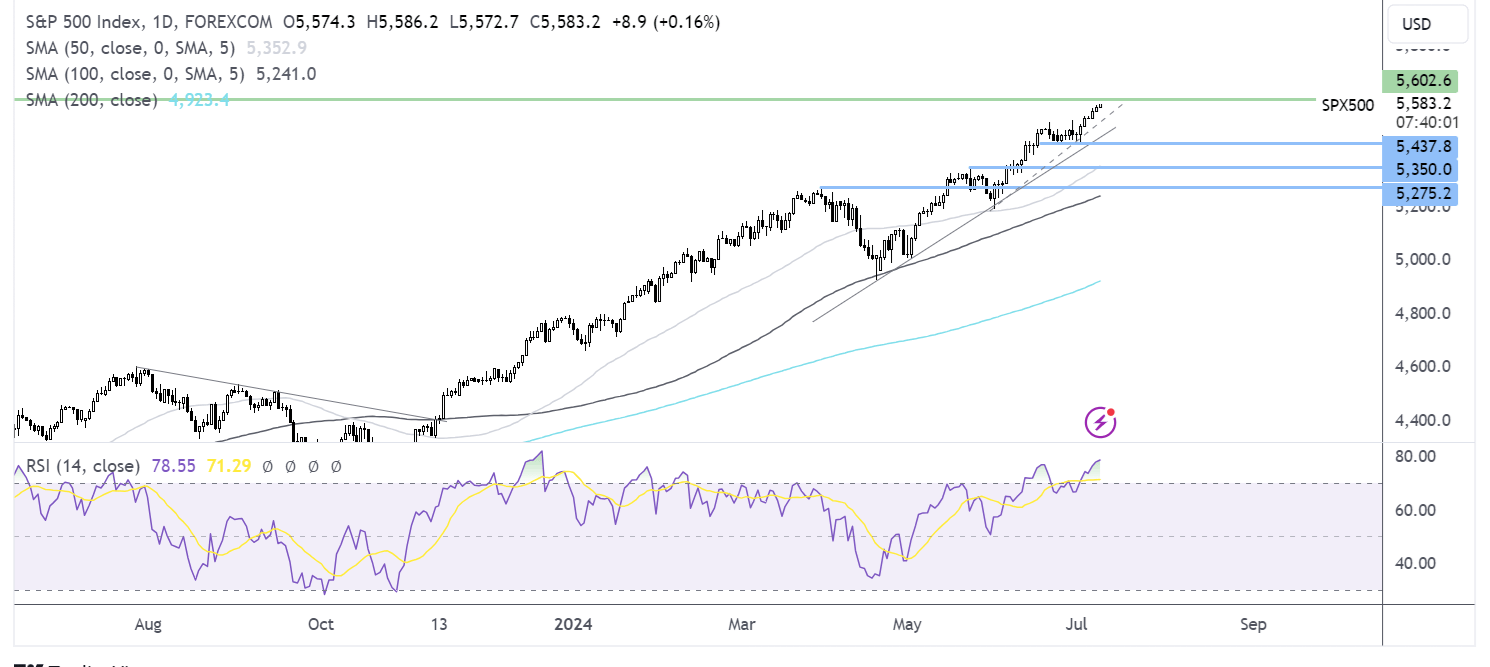

S&P500 forecast – technical analysis.

The S&P 500 trades around its ATH. Buyers will look to extend gains towards 5600. However, the RSI is overbought so some consolidation or a move lower could be on the cards. Support can be seen at 5445, the July low and rising trendline support. Below here, 5310, the May high comes into play.

FX markets – USD rises, EUR/USD falls

The USD is inching higher for a second day as investors await commentary from Federal Reserve chair Jerome Powell. Any sense that the Fed is increasingly dovish could pull the USD lower.

EUR/USD is modestly weaker but holding about 1:08 as the market continues to digest the shock election result of a hung parliament. Meanwhile, Moody's rating agency has warned about the French debt outlook, saying if its fiscal and debt metrics materially worsen, then a sovereign rating downgrade is at risk.

GBP/USD is holding steady around 1.28 in quiet trade and as markets weigh up Bank of England commentary and BRC retail sales data. BoE policymakers are now out of the blackout period they had been in throughout the election. BoE policymaker Jonathan Haskel warned about cutting interest rates too soon while price pressures remain in the jobs market and the services sector. Elsewhere, BRC retail sales fell 0.5%, on a like-for-like basis, due to poor weather, after rising by 0.4% in May.

Oil falls as supply worries ease.

Oil prices are falling after hurricane Beryl caused less damage than expected to oil-producing regions. Concerns over supply disruption are easing.

Meanwhile, the markets are also eyeing the situation in the Middle East amid optimism of a potential ceasefire deal in Gaza. Should this occur, it would help reduce concerns over crude oil supply in the region.

Looking ahead, the API will release estimates for weekly crude oil inventories later today and an adraw is expected, given the summer driving season.