On Friday, we saw bond yields dip sharply post a disappointing US jobs report. Surprisingly, this did not bolster gold prices as expected. Despite climbing to a weekly high, gold then reversed and dropped. This anomaly was probably due to the continued sell-off in stocks, which forced the liquidation of leveraged long trades, negatively impacting gold. However, the downside appears limited, and new all-time highs are still within reach. Our gold forecast remains bullish.

NFP Disappointment and Its Impact on Gold

The latest US jobs report underwhelmed expectations, causing the dollar to drop. Yet, gold did not capitalise on this weakness and instead reversed its gains. The report caused a broader risk-off sentiment in the market, as bonds surged, and stocks plunged. This data rounded off a week characterised by weaker US economic figures, a slightly less dovish Federal Reserve than expected, and a surprisingly hawkish Bank of Japan. With the ISM services PMI set for release on Monday, further volatility is anticipated.

The headline non-farm payrolls data fell short, showing +114K jobs added versus an expected +176K. Additionally, the unemployment rate unexpectedly rose to 4.3%, suggesting a cooling job market. Average earnings growth also lagged at 0.2% month-over-month compared to the 0.3% forecast. These developments have led to a fully priced-in September rate cut, with at least two more cuts anticipated by the end of 2024. This trend is unfavourable for the US dollar, we believe.

Looking Ahead: ISM Services PMI

The upcoming week’s highlight is the ISM services PMI report from the US, slated for release on Monday, August 5. This follows last week's poor ISM manufacturing PMI, which spurred recession concerns and declines in stocks and bond yields. The services PMI is expected to rebound to 51.3, indicating expansion, after a surprising drop to 48.8 last month. The previous contraction was driven by a slump in business activity and new orders, contracting for the first time since May 2020.

Given the Federal Reserve's increasing focus on employment, attention will be on the employment component of the ISM services PMI, as well as the headline figure. This report could significantly influence market sentiment and gold prices in the near term.

Gold Forecast: Technical Analysis

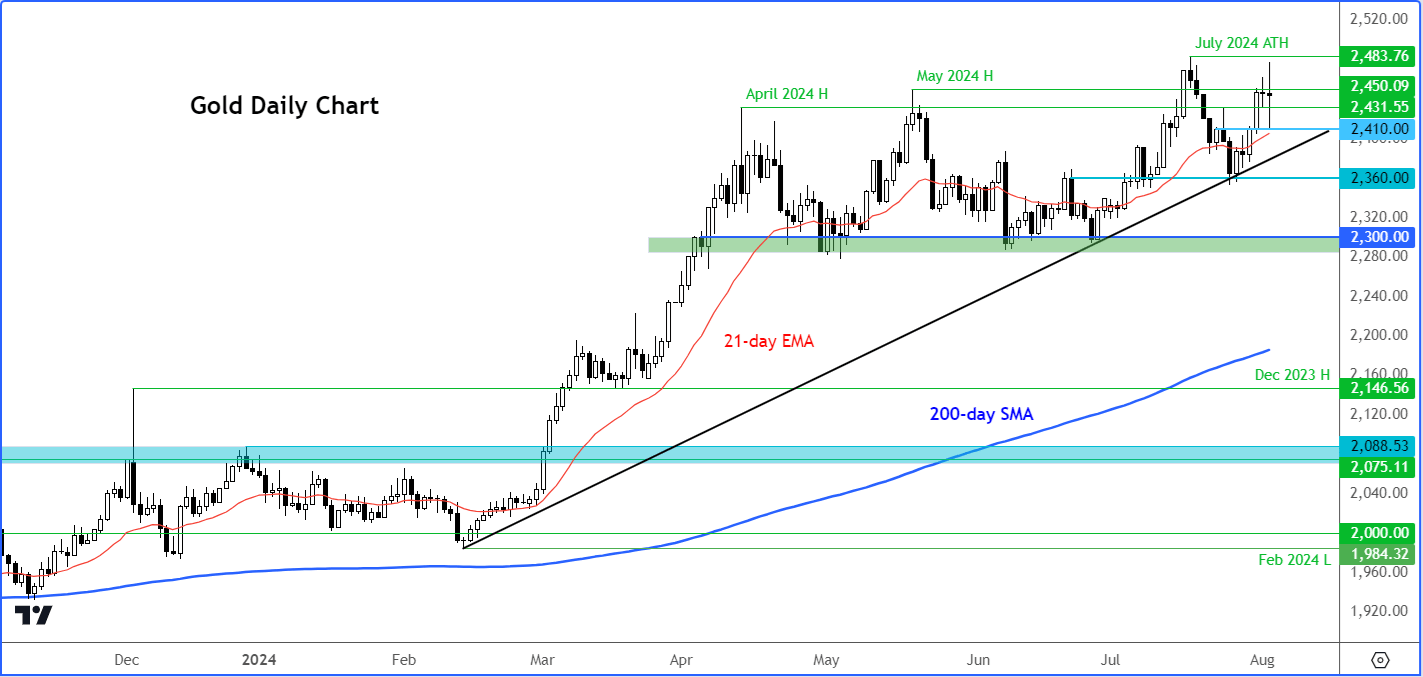

Source: TradingView.com

Source: TradingView.com

The trend is quite clearly bullish on the gold chart. Until such a time we see a breakdown in the trend of higher highs and higher lows, we will give the bulls the benefit of the doubt and maintain our bullish technical gold forecast. Support levels are seen at $2431, $2410 and $240. Resistance is seen at $2450, followed by the all-time high that was hit in July at $2483.

In a nutshell

In summary, our gold forecast remains cautiously optimistic despite Friday’s setback. Market participants should closely monitor economic indicators in the week ahead as well as Fed speeches, as these will play crucial roles in shaping gold prices. The upcoming ISM services PMI report is particularly pivotal, potentially driving significant market movements. As always, a balanced approach, considering both macroeconomic trends and specific market signals, will be essential for navigating the gold market effectively.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R