NFP Key Points

- NFP report expectations: +212K jobs, +0.3% m/m earnings, unemployment at 3.9%

- Leading indicators point toward slightly above expectation reading in this month’s NFP report, with headline job growth in the 200K-250K range.

- The US Dollar Index (DXY) is sitting in the middle of its 3-month range near 104.00 ahead of the jobs report.

When is the March NFP Report?

The March NFP report will be released on Friday, April 5, at 8:30 ET.

NFP Report Expectations

Traders and economists expect the NFP report to show that the US created 212K net new jobs, with average hourly earnings rising 0.3% m/m (4.3% y/y) and the U3 unemployment rate ticking holding steady at 3.9%.

NFP Overview

The US economy has thus far defied expectations for a slowdown to start 2024, and tomorrow’s NFP report is the next major hurdle for growth optimists to clear.

Source: StoneX

US economic data in recent weeks has remained generally strong, though there are some signs of a potential downshift (such as in Wednesday’s 4-year low in the ISM Services Prices Paid component) if you look hard enough, which Fed Chairman Jerome Powell seems keen to do. Along with a resumption of last year’s disinflation, the central bank will be looking for the strength in the labor market to subside before having enough confidence to start cutting interest rates.

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Services PMI Employment component rose to 48.5 from 48.0 last month.

- The ISM Manufacturing PMI Employment component bumped up to 47.4 from 45.9 last month.

- The ADP Employment report showed 184K net new jobs, an incremental increase from last month’s upwardly-revised 155K reading.

- Finally, the 4-week moving average of initial unemployment claims rose slightly to 214K, up from 212K last month but still near historically low levels.

Weighing the data and our internal models, the leading indicators point to a slightly above expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 200-250K range, albeit with a big band of uncertainty given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at just 0.1% m/m in the most recent NFP report.

Potential NFP Market Reaction

|

|

Wages < 0.2% m/m |

Wages 0.2-0.4% m/m |

Wages > 0.4% m/m |

|

< 175K jobs |

Bearish USD |

Slightly Bearish USD |

Slightly Bullish USD |

|

175K - 250K jobs |

Slightly Bearish USD |

Neutral USD |

Slightly Bullish USD |

|

> 250K jobs |

Slightly Bearish USD |

Slightly Bullish USD |

Bullish USD |

As we outline below, the US dollar sits in the middle of its range over the past month (and indeed the past 3 months). With the greenback not testing a clear support/resistance level and the Fed’s path seemingly set until June (meaning two more jobs reports – and 3 more inflation reports) before the central bank is likely to make any tweaks to interest rates, the risks are balanced and volatility may be lower than usual around this month’s NFP report.

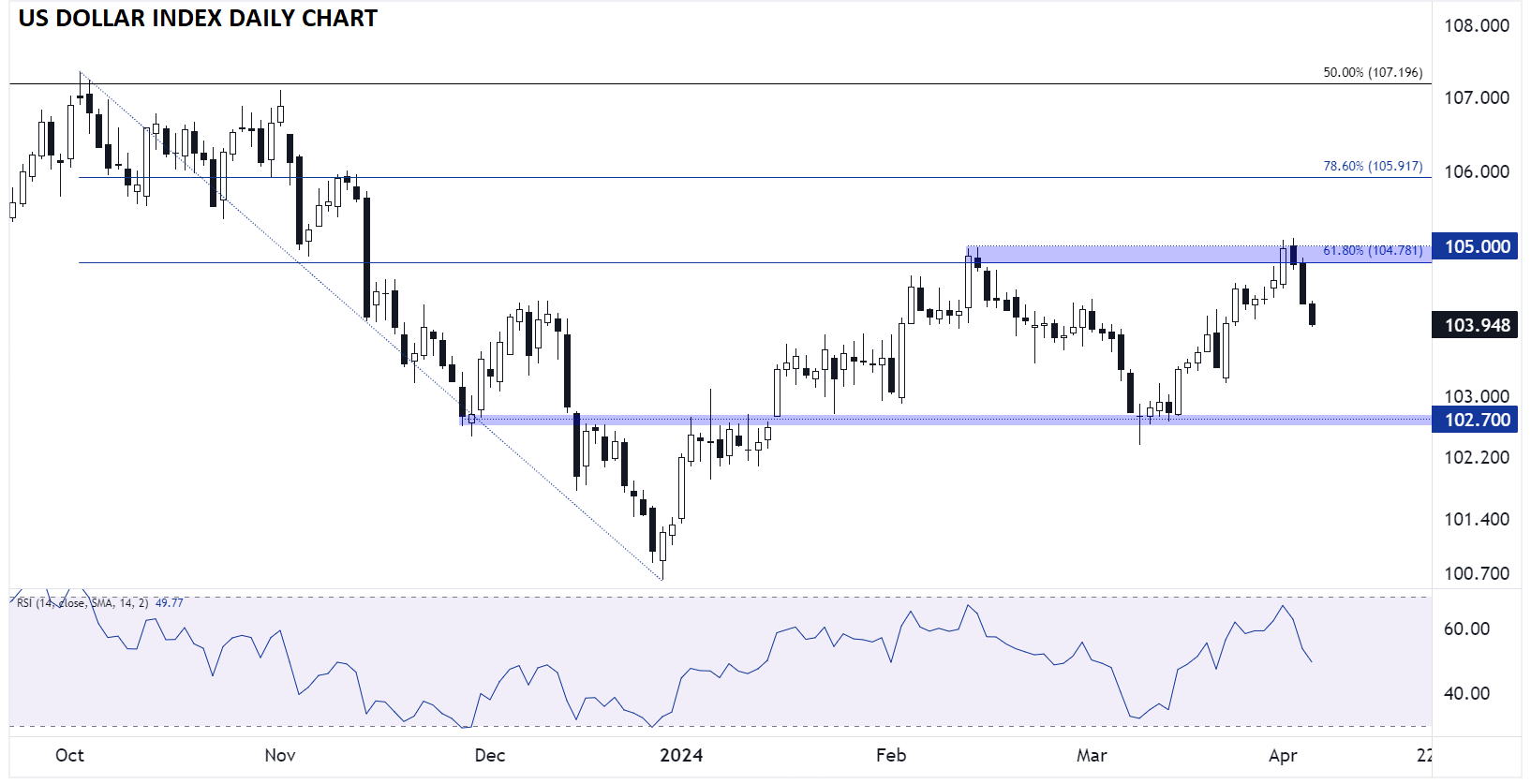

US Dollar Technical Analysis – DXY Daily Chart

Source: TradingView, StoneX

The US Dollar Index closed at its highest level since November on Monday, but sellers have come out in force as economic data has cooled off this week to push the index down more than 100 pips. Now, DXY is sitting in the middle of 3-month range near 104.00, leaving a balanced technical outlook heading into the NFP report.

If we do see another strong jobs reading, DXY could bounce back toward the top of the range in the upper 104.00s as traders sour on the potential for a Fed rate cut in June, whereas a softer-than-expected NFP report would likely extend this week’s selling and push the Dollar Index toward the low-103.00s.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX