US futures

Dow future -0.45% at 39,163

S&P futures -0.09% at 5286

Nasdaq futures- 0.25% at 18690

In Europe

FTSE -0.72% at 8313

Dax -0.25% at 18616

- Stocks inch lower in cautious trade

- US consumer confidence is expected to fall further

- US core PCE data is due on Friday

- Oil recovers from weekly low

Stocks inch lower with Friday's inflation data in focus

US stocks point to a modestly lower open as traders return from a long holiday weekend and look ahead to a key inflation data later in the week.

Friday will see the release of core PCE, the Fed's preferred measure of inflation. A string of Federal Reserve officials have said that they would like to see more proof that US inflation is cooling before they start cutting interest rates.

The market has recently pushed back Federal Reserve rate cut expectations following last week's hawkish FOMC minutes and stronger-than-expected US PMI data.

Today, the US economic calendar is quieter, with just the latest Conference Board consumer confidence surveys for June. The index is expected to show a slight fall to 96, down from 97 in the previous month. In April, the index fell to its lowest level in 1.5 years as Americans fretted over high prices and the availability of jobs.

Meanwhile, earning season is ramping down, although several companies are still left to unveil their latest results in the coming days. These include Salesforce, which will report after the close on Wednesday, and Costco Retail, which will report after the bell on Thursday.

Corporate news

NVIDIA is is set to open 2.5% higher as the AI darling continues to gain following last week's impressive result. Its market cap has the past 2.5 trillion, solidifying its position as the third most valuable company in the US.

Apple is set to rise 2% after the iPhone maker saw a 52% increase in smartphone shipments to China in April compared to a year earlier. The rebound continues following steep declines in the first two months of the year. Apple and its Chinese resellers have been cutting prices since the start of 2024, and those deals are extending into the sales season.

Game stock has jumped over 24% after the video game retailer reported that it made over 933 million from the sale of 45,000,000 shares.

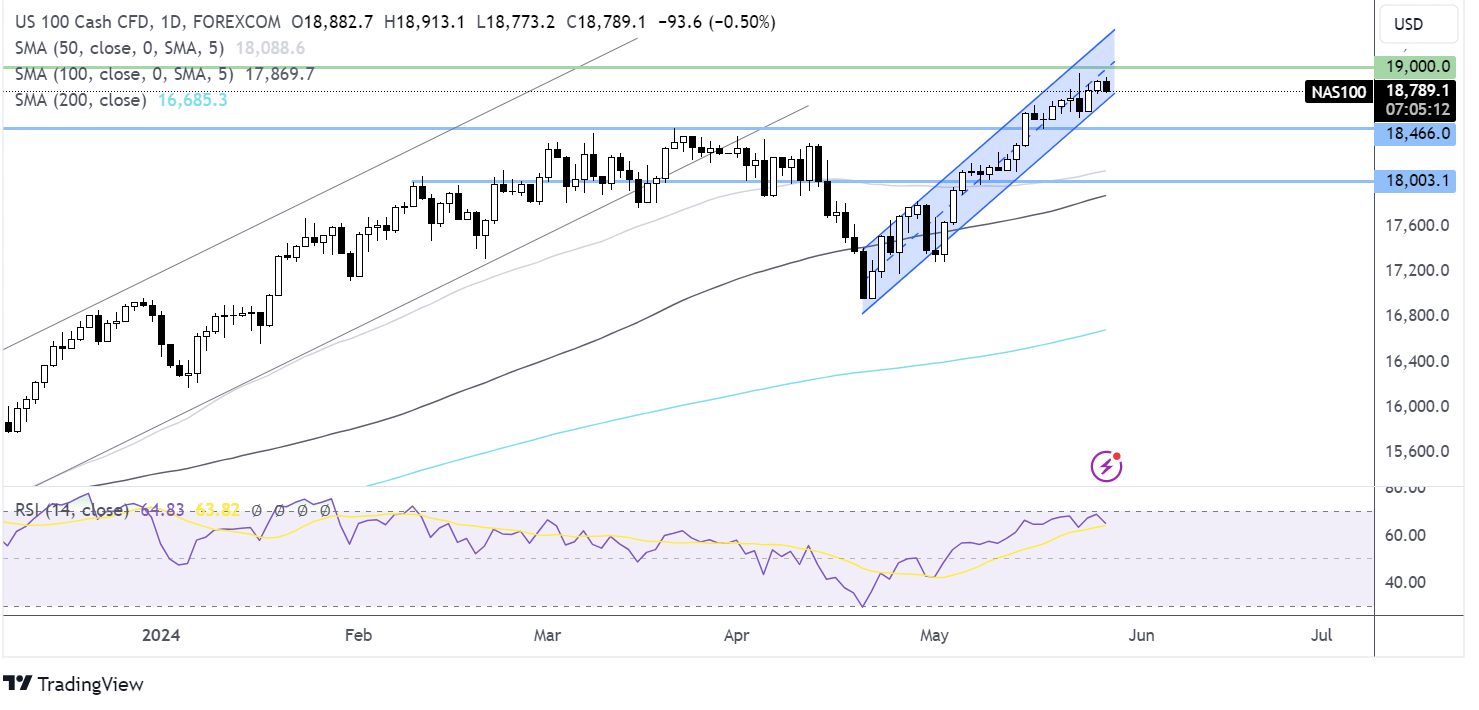

Nasdaq 100 forecast – technical analysis.

The Nasdaq is trading within its rising channel. The price is consolidating below the ATH of 18947 reached last week. Buyers will look to rewards of 19000 and fresh all-time highs. There is little in the way of support until 18466, the March high, with a break below here opening the door to 18000.

FX markets – USD falls, EUR/USD rises

The USD is weakening further ahead of US inflation data this week, despite Federal Reserve officials supporting the view that interest rates need to stay high for longer. The U.S. dollar has set for its first monthly decline this year on expectations that the US central bank will cut rates in 2024.

EUR/USD is rising after German wholesale prices increased by more than expected, rising 0.4% MoM in April from 0.2% in March. Meanwhile, the ECB noted that consumer inflation expectations for the region fell to 2.9%, down from 3%, paving the way for a June rate cut, although what comes thereafter is less certain.

GBP/USD is rising amid a weaker USD and despite the BRC reporting shop price inflation easing to the weakest level in 2 years. The BRC saw price growth slow to 0.6% from 0.8%.

Oil recovers from last week’s lows

Oil prices are rising for a fourth straight day amid hopes of strong US summer fuel demand and on prospects of OPEC+ keeping supply cuts in place at the meeting later this week.

OPEC+ is due to meet on June 2nd. The oil group is expected to maintain the 2.2 million barrels per day of voluntary production cuts.

Meanwhile, data from the US showed that domestic flight travel rose 5% month over month in May, supporting this view of strong demand as driving season also kicks off in the US.

Signs of upbeat demand are offsetting concerns over the prospect of higher interest rates for longer in the US, which could dampen economic growth and, therefore, oil demand going forward.