GBP/USD Key Points

- GBP/USD traders are increasingly confident that the Bank of England (BOE) will keep its benchmark interest rate “higher for longer” than many of its peers.

- The UK General Election is now one month away, but Labour looks likely to secure a majority based on current polling data.

- GBP/USD remains in a longer-term uptrend, so traders may be keen to buy any dips toward the 50-day EMA near 1.2600 this week.

Last week was a quiet one for UK economic data, and the coming week doesn’t look too thrilling either…though at least traders should be at their desks for the whole week this time around!

For GBP/USD traders, there are two longer-term stories to watch this week.

First, traders are increasingly confident that the Bank of England (BOE) will keep its benchmark interest rate “higher for longer” than many of its peers. Many traders believe that the BOE will hold off until at least after the UK General Election (more below) on July 4 before making any tweaks to interest rates, and after recent data showed a slower-than-expected decline in UK inflation, traders are starting to speculate that the BOE may only cut interest rates a single time this year, far below the handful of cuts that were anticipated at the beginning of the year. If UK economic data continues to come in better than expected, there is still room for this theme to drive additional strength in Sterling.

The other key storyline to watch is imminent UK General Election, which is now only a month away. Typically, the injection of political uncertainty can make the currency in question fall, but at least according to early polls, there is less uncertainty than usual around this election. The Labour party maintains a comfortable lead in polls, and The Economist’s election model projects a 93% chance that the party will win a majority of seats, and only a 1-in-100 chance that it doesn’t secure the most seats:

Source: The Economist

While the polls could swing toward the Tories in the coming week, they’ve been relatively stable in favor of Labour so far. Assuming no surprises (always a risk when it comes to elections!), the bigger event for GBP/USD traders may be around the new government’s budget, which can reveal domestic priorities and set the projected level of government spending; experienced traders will recall the Liz Truss/Kwasi Kwarteng budget fiasco of 2022 that led to GBP/USD falling to near parity for the first time in its 200+ year history.

UK Economic Data for GBP/USD Traders to Watch This Week

As noted above, it’s poised to be a quieter week for UK economic data, but GBP/USD traders will still want to tune in for the following reports from the island nation:

Monday

Final Manufacturing PMI (May)

BRC Retail Sales Monitor (May)

Tuesday

40-Year Gilt Auction

Wednesday

New Car Sales (May)

Final Services PMI (May)

Final Composite PMI (May)

3-Year Gilt Auction

Thursday

Construction PMI (May)

Friday

Halifax House Price Index (May)

BBA Mortgage Rate (May)

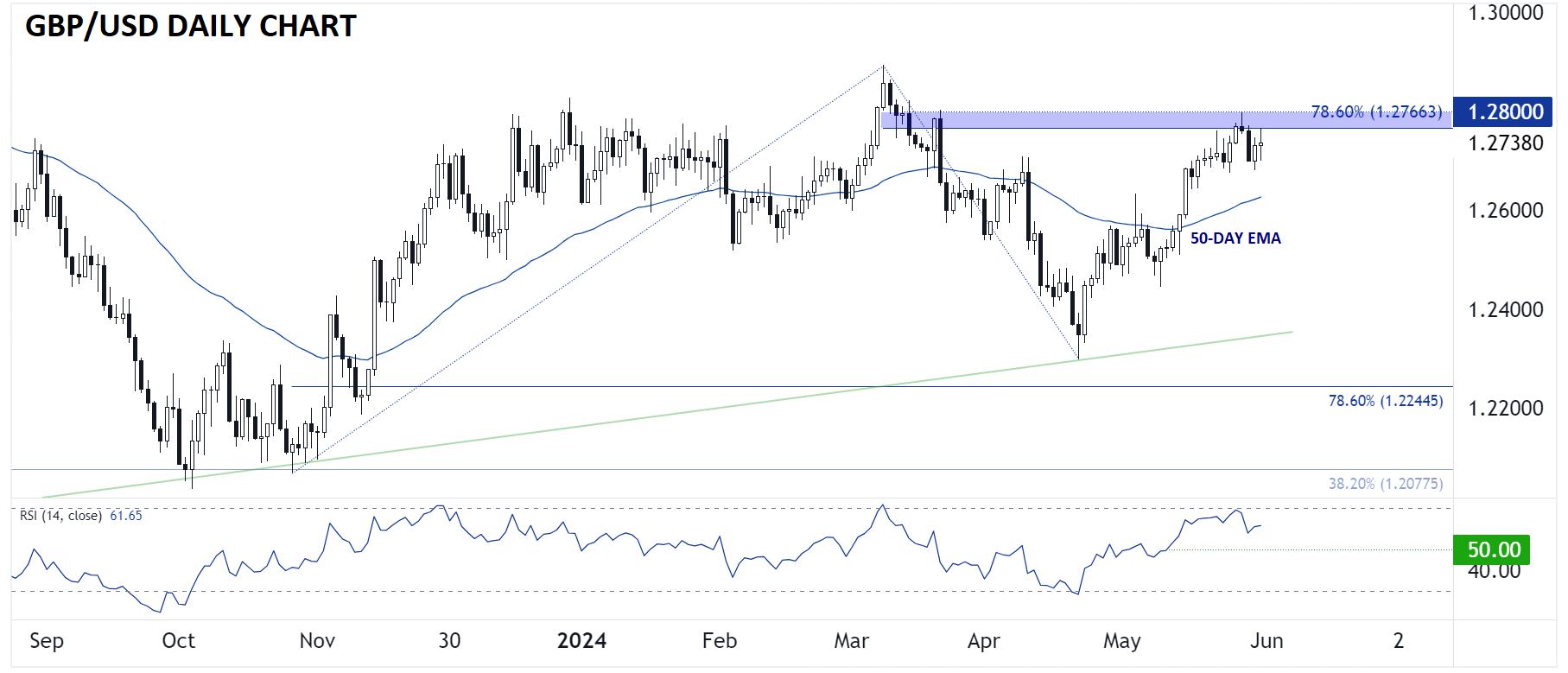

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

Looking at the daily chart of GBP/USD, rates are consolidating just below resistance in the 1.2770-1.2800 range after testing the top of that zone midway through last week. The pair remains in a longer-term uptrend (off the aforementioned 2022 budget fiasco low), so traders may be keen to buy any dips toward the 50-day EMA near 1.2600 this week, but the more interesting development would be a breakout above 1.2800. In that scenario, traders would start to turn their eyes toward the year-to-date high around 1.2900, followed by the psychologically-significant 1.3000 level in time.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX