US futures

Dow future 0.17% at 39784

S&P futures 0.24% at 5645

Nasdaq futures 0.30% at 20730

In Europe

FTSE 0.25% at 8209

Dax 0.77% at 18498

- Banks earnings are mixed

- PPI was hotter than expected +0.2% MoM

- USD trades around a monthly low

- Oil is on track for another weekly rise

Banks mixed as earnings season kicks off

U.S. stocks point to a modestly stronger start as investors digest hotter-than-expected producer price inflation and the start of earnings season.

PPI rose 0.2% monthly compared to the 0.1% expected, which rose 2.6% annually versus the 2.3% expected. The hotter-than-expected PPI data comes after CPI data that was cooler than expected yesterday, which added to expectations that the Federal Reserve may start to cut interest rates soon.

The data is a key reminder that inflation remains volatile even as the market is pricing in a 93% probability that the Fed will cut rates in September.

Attention now is turning to the earning season.

The S&P500 and the NASDAQ 100 fell from record highs yesterday as investors hoped that strong profit growth from big tech names would start to broaden.

The S&P500 and the Nasdaq 100 booked the steepest fall in over two months on Thursday amid a rotation out of large tech and into the small-cap, which has underperformed this year.

Concerning earnings season, the bar is set a little higher. Expectations are for the S&P 500 profits to grow by 10.1% in Q2 compared to a year earlier. Financial firms are likely to post profit growth of 6.7%

Corporate news

JP Morgan is unchanged after reporting earnings and revenue that beat expectations. The largest US bank by assets posted EPS of $4.40 ahead of the $4.14 forecast. Revenue rose 20% TO $50.99 billion, ahead of the $49.87 billion estimated. Strong investment banking numbers revenue boosted results.

Citigroup rises after beating Wall Street’s expectations for both earnings and revenue. The third largest US lender posted a profit of $1.52 versus $1.39 expected. Profits were boosted by a 60% jump in investment banking revenue and gains in its services division. The data comes just days after the US regulator fined Citigroup $136 million for its lack of progress in fixing data management issues.

Wells Fargo is set to open 5% lower as the lender missed forecasts for interest income owing to the high interest rate, although it beat earnings and revenue expectations.

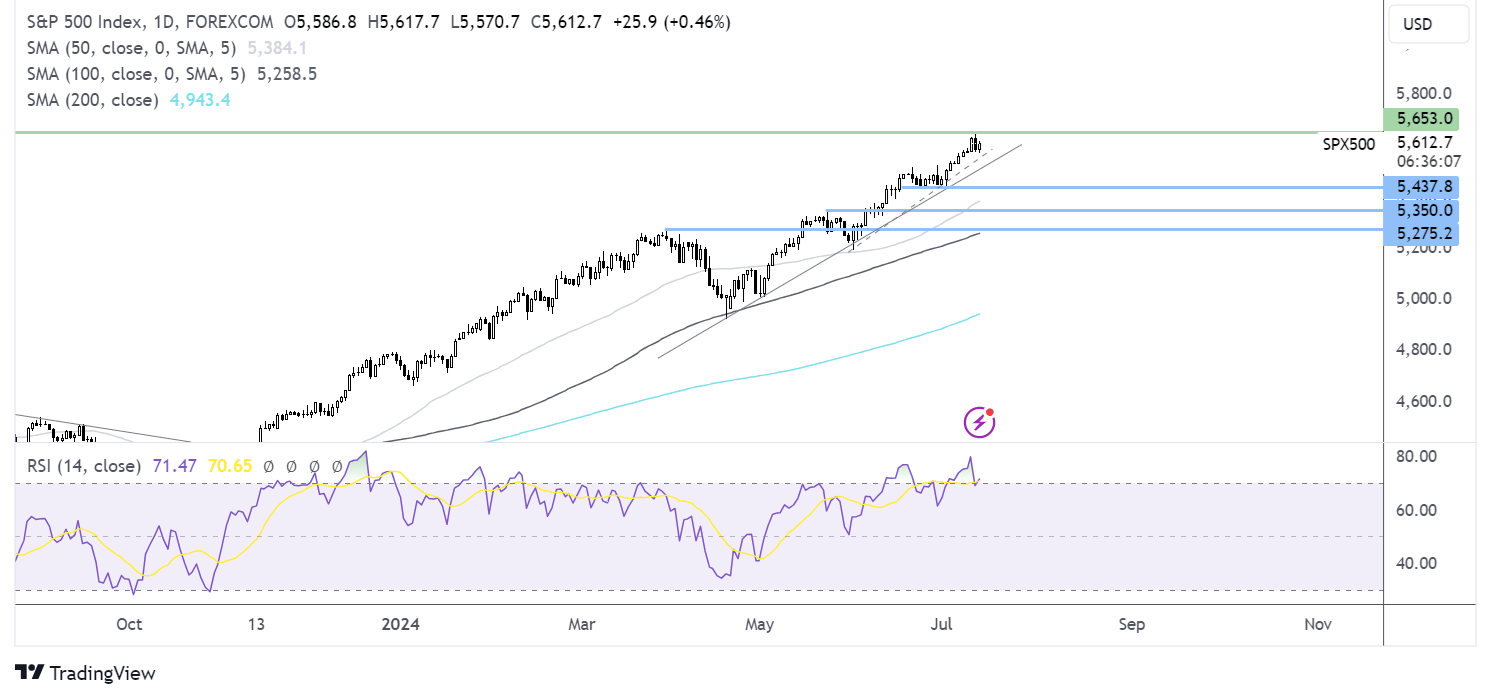

S&P 500 forecast – technical analysis.

The S&P500 fell away from the all-time high of 5653, pulling the RSI out of overbought territory. Traders are buying the dip, looking to retake 5653 and reach fresh ATHs. Minor support sits at 5550, the weekly low. Below here, support can be seen at 5445, the July low.

FX markets – USD falls, GBP/USD rises

The USD is falling as it trades at a monthly low following weaker-than-expected US inflation data, fueling bets that the Fed could cut interest rates sooner.

EUR/USD is rising, and trades have reached their highest level in five weeks despite German wholesale prices falling more than expected in June. German wholesale prices fell 0.3%, defying expectations of a rise of 0.2%. The data came after German inflation cooled 2.2% in June and ahead of the ECB interest rate decision next week. The ECB is not expected to move on rates given the sticky service sector inflation and strong wage growth.

GBP/USD is rising towards 1.30 and trades at a yearly high after stronger UK GDP data and hawkish commentary from the Bank of England reined in rate cut expectations. The market is pricing in just a 50/50 probability of an August cut and an 88% probability of a September cut.

Oil holds steady on mixed demand signal.

Oil prices rose on Friday for a third straight day and are expected to book gains of 0.2% across the week, marking the fifth straight week of gains.

Oil prices are rising amid signs of inflationary pressures easing in the US, the world's largest consumer of oil. Cooling inflation supports the view that the Fed will start easing monetary policy sooner rather than later.

Indications of solid summer demand also support the oil price after gasoline demand was at 9.4 million barrels at the end of the week ending July the 5th, its highest level since 2019. The data included the Independence Day holiday