US futures

Dow future 0.15% at 39433

S&P futures 0.07% at 5570

Nasdaq futures 0.05% at 20395

In Europe

FTSE 0.45% at 8226

Dax 0.77% at 18556

- Stocks edge higher, close to the record-high

- Powell will testify before Congress this week

- Tesla holds onto 27% gains from last week

- Oil falls on ceasefire hopes

Stocks inch higher close to the record highs

U.S. stocks point to a positive start, adding to last week’s gains. This is ahead of a key week for further cues over when the Federal Reserve may start to cut rates.

Stocks posted strong gains last week, with the Nasdaq 100 rising 3.5% to a record high and the S&P 500 gaining 1.9%. Meanwhile, the Dow posted gains of 0.66%.

Stocks rose after data showed signs of a slowing economy and jobs market, fueling expectations that the Federal Reserve could cut interest rates sooner.

This week attention will be on US inflation data and Federal Reserve chair Jerome Powell as he testifies before the Senate Banking Committee in a bi-annual event. The market will be watching closely for signs of a more dovish-sounding Powell, particularly after Friday’s NFP report, which showed a rise in unemployment.

Unemployment ticked higher to 4.1%. This is particularly important given that Federal Reserve chair Jerome Powell has previously said that a meaningful increase in unemployment is needed for a rate cut.

The market is pricing in a 76% probability that the Fed will cut rates in September, up from 56% at the start of last week.

Corporate news

Paramount rises pre-market after Skydance Media agreed to buy the entertainment giant for $8 billion.

Tesla is set to open 1% lower after rising to its highest level this year on Friday. The EV maker posted stronger than expected Q2 deliveries on July 2, sending the share price 27% higher across the week.

Boeing is set to rise 0.7% on the open after the airplane manufacturer agreed to plead guilty to a criminal fraud conspiracy change from the DoJ relating to an investigation into two 737 Max fatal crashes.

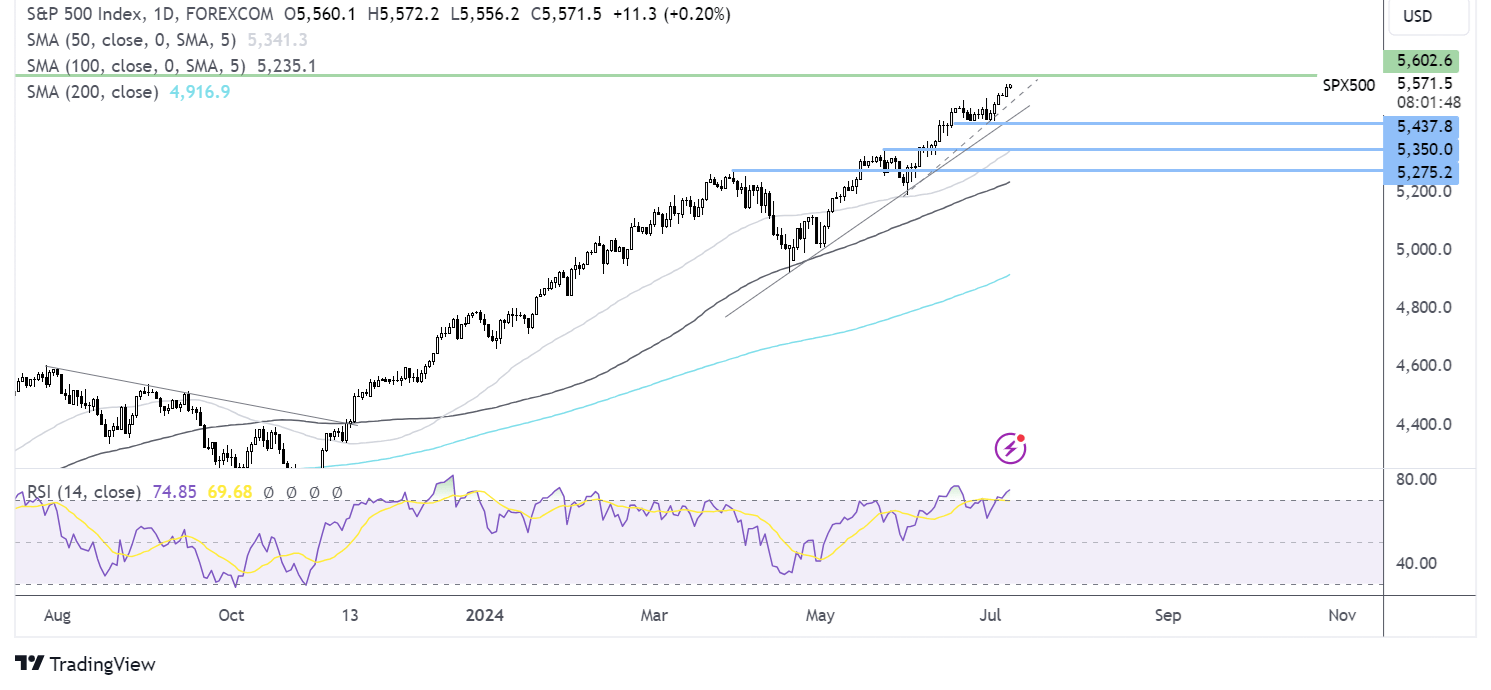

S&P500 forecast – technical analysis.

The S&P 500 trades around its ATH. Buyers will lokk to extend gains towards 5600. However, the RSI is overbought so some consolidation or a move lower could be on the cards. Support can be seen at 5445 the July low and rising trendline support. Below here 5310, the May high comes in to play.

FX markets – USD falls, GBP/USD rises

The USD remains under pressure after booking losses of almost 1% across the previous week. Signs of a slowing economy amid a softer labor market have pulled the USD lower. Inflation data and Federal Reserve chair Powell’s testimony this week will set the tone for USD.

EUR/USD is inching lower after a shock result from the French election over the weekend. The left-wing alliance emerged victorious, while Macron’s centrist party came second. Marine Le Pen’s far-right National Rally was a surprise third place. Still, the market reaction has been relatively muted, given that the left failed to win an absolute majority. The result will be a hung parliament, which could limit the Left alliances’ spending plans. Eurozone Sentix investors' sentiment slumped in July.

GBP/USD is rising after the new Chancellor of the Exchequer, Rachel Reeves, pledged stability and reform for planning to boot the UK economy. Data from the BRC showed that fewer firms are planning price rises over the coming months. The data will come as a relief to the Bank of England policymakers as they assess whether to cut interest rates in August.

Oil falls on ceasefire hopes.

Oil prices are falling around 1% at the start of the week after posting four straight weekly games. The price is being driven lower by hopes of progress in ceasefire takes over Gaza, although supply worries are capping losses as hurricane Beryl hits the US.

Talks for a ceasefire to end the war in Gaza, which has been going on for nine months, are being led by the Qataris and Egyptians. Any concrete outcomes of these talks could reduce the risk premium on oil prices, pulling the price lower.

Meanwhile, hurricane Beryl hit the US on Sunday in Texas. Several ports were closed on Sunday in preparation for the hurricane, which could temporarily halt the export of oil shipments. However, the bigger concern will be the Hurricane hitting the oil refinery infrastructure.