US futures

Dow future -0.5% at 38,779

S&P futures 0.05% at 5354

Nasdaq futures 0.09% at 19047

In Europe

FTSE 0.46% at 8279

Dax 0.69% at 18657

- Jobless claims rise to 229k from 221k

- ADP payrolls and jolts job openings were weaker

- Fed rate cut expectations rise

- Oil rises for a second day

Signs of weakness in the labour market support rate cut bets

U.S. stocks are pointing to a quiet open after the S&P 500 hit a record high in the previous session, boosted by gains in Nvidia and optimism that the Federal Reserve will start to cut interest rates sooner.

US jobless claims rose by more than expected to 229k, up from 221k in the previous week and defying expectations of a decline to 220k. The data comes hot on the heels of weaker-than-expected ADP private payrolls, and a softer-than-expected jolts job opening report, supporting the view that the US labour market is cooling. This should in term help wage growth and price pressures to ease giving the Federal Reserve more reasons to cut interest rates.

Expectations that the Fed will cut rates by 25 basis points in September are rising as central banks worldwide have started to cut interest rates. Yesterday, the Bank of Canada cut rates by 25 basis points and the ECB followed suit today.

The market is currently pricing in a probability of around 68% of a September Fed rate cut. This is up considerably from below 50% at the end of last week. A lower interest rate environment is beneficial for businesses and consumers.

Attention is turning to tomorrow’s non-farm payroll report, which could help to cement expectations of a rate cut at the end of the summer.

Corporate news

Nvidia is set to open over 1% higher, continuing yesterday’s gains after the AI chipmaker’s market cap topped $3 trillion in the previous session, overtaking Apple as the world's second-most valuable company.

Lululemon Athletica is set to open over 8% higher after the sportswear retailer posted Q1 profits and sales that beat forecasts and also raised its annual guidance.

Neo is set to open at 3% lower after the Chinese EV maker posted Q1 results that missed forecasts amid intense competition, although they did provide an upbeat outlook for the current quarter.

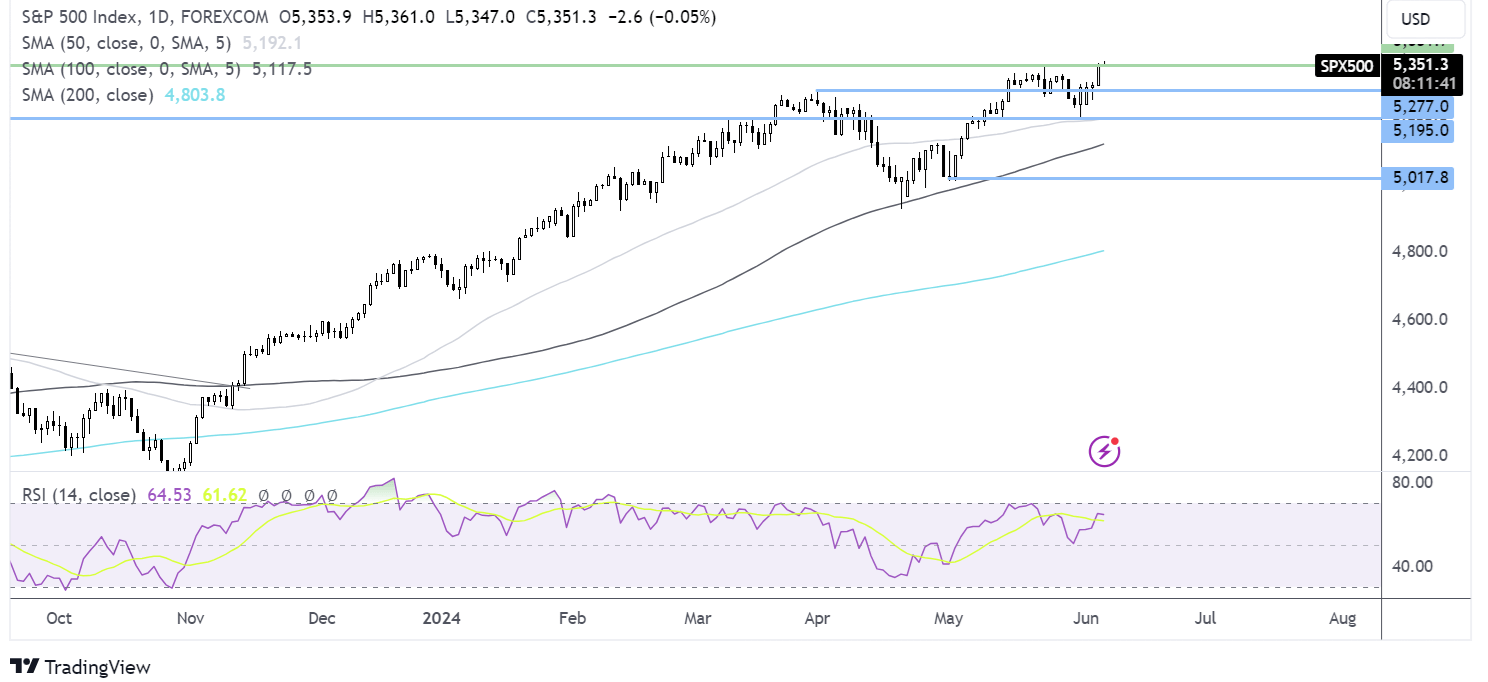

S&P 500 forecast – technical analysis.

After closing above 5277, the S&P 500is testing resistance at 5050 , a rise above here opens the door to fresh ATHs. Immediate support is at 5277, the April high. Below here, 5190, the May low, comes into play.

FX markets – USD holds steady, GBP/USD falls

The USD hovers around the two-month low as investors shrug off yesterday’s strong expected ISM services PMI and focus on the weaker labor date ahead of tomorrow's nonfarm payroll.

EUR/USD: The ECB cut interest rates as expected by 25 basis points to 3.75%, marking the first rate cut in almost five years. The ECB said it would not commit to a particular path for rates, and inflation is expected to remain above target well into next year. Attention will now turn to the press conference, which is due shortly, for further clues over the ECB's next moves.

GBP/USD is falling despite the UK construction PMI, which shows that the sector recorded its strongest growth in two years. The PMI rose to 54.7 in May, up from 53 in April, beating forecasts of a fall to 52.5. The data comes after the composite PMI released earlier in the week dropped to 53.1 from April's 54 amid slower growth in the service sector.

Oil rises for a second day.

Oil prices are rising for a second straight day as the recent sell-off stabilizes. Oil has recovered from a four-month low amid growing expectations that the Federal Reserve could cut interest rates in September, offsetting higher US inventories and worries and OPEC+ plans to increase supply.

Lower interest rates decrease the cost of borrowing, which can boost economic activity and improve the oil demand outlook. Meanwhile, the weaker U.S. dollar, which trades near a two-month low, also helps oil prices, making it cheaper for buyers with foreign currencies.

The upside may be limited given that the OPEC+ group agreed to potentially increase supply later in the year as voluntary production cuts are gradually unwound.