US futures

Dow future 0.35% at 38,826

S&P futures 0.45% at 5314

Nasdaq futures 0.75% at 18788

In Europe

FTSE 0.46% at 8272

Dax 1.08% at 18614

- ADP payrolls rose 15k vs 188k previously

- US ISM services PMI data are expected to rise to 50.5

- Oil steadies near a 4-month low

Stocks rise as rate cut expectations increase

U.S. stocks are firmly higher after more weak data supports the view that the Federal Reserve could cut interest rates sooner.

ADP private payrolls were much weaker than expected in May, falling to 152K, down from an upwardly revised 188K in April. This marked the slowest pace of hiring since the start of the Manufacturing payrolls saw the steepest decline since last July, perhaps not surprising after the softer manufacturing PMI data. Yesterday, the Jolts job openings showed the lowest number of job openings compared to people available to work in three years.

The data is starting to paint a clear picture that job gains and pay growth are slowing as we head into the second half of the year. The data comes ahead of Friday's nonfarm payroll report, which is expected to show 185,000 jobs added in May.

Recent data shows the US economy is slowing, adding to expectations that the Federal Reserve will cut rates sooner. The market is now pricing in a 65% probability of a rate cut in September, up from under 50% last week.

Looking ahead, attention will also be on services PMI data, which is expected to rise to 50.5 from 49.4. Weaker-than-expected data could fuel those rate-cut bets and lift the stocks higher.

However, it is worth noting that after weaker-than-expected manufacturing data on Monday, stocks slumped on fears over the health of the US economy. So, we have been seeing a mixed narrative highlighting investors' indecision.

Corporate news

Hewlett Packard Enterprise is set to open 15% higher after the software consultancy posted strong quarterly earnings and an upbeat outlook fueled by AI demand.

CrowdStrike is expected to open over 10% higher after the cyber security firm lifted its annual guidance following better-than-expected quarterly earnings.

Dollar Tree is set to open over 1% lower after reporting plans to explore options, including a spin-off of Family Dollar.

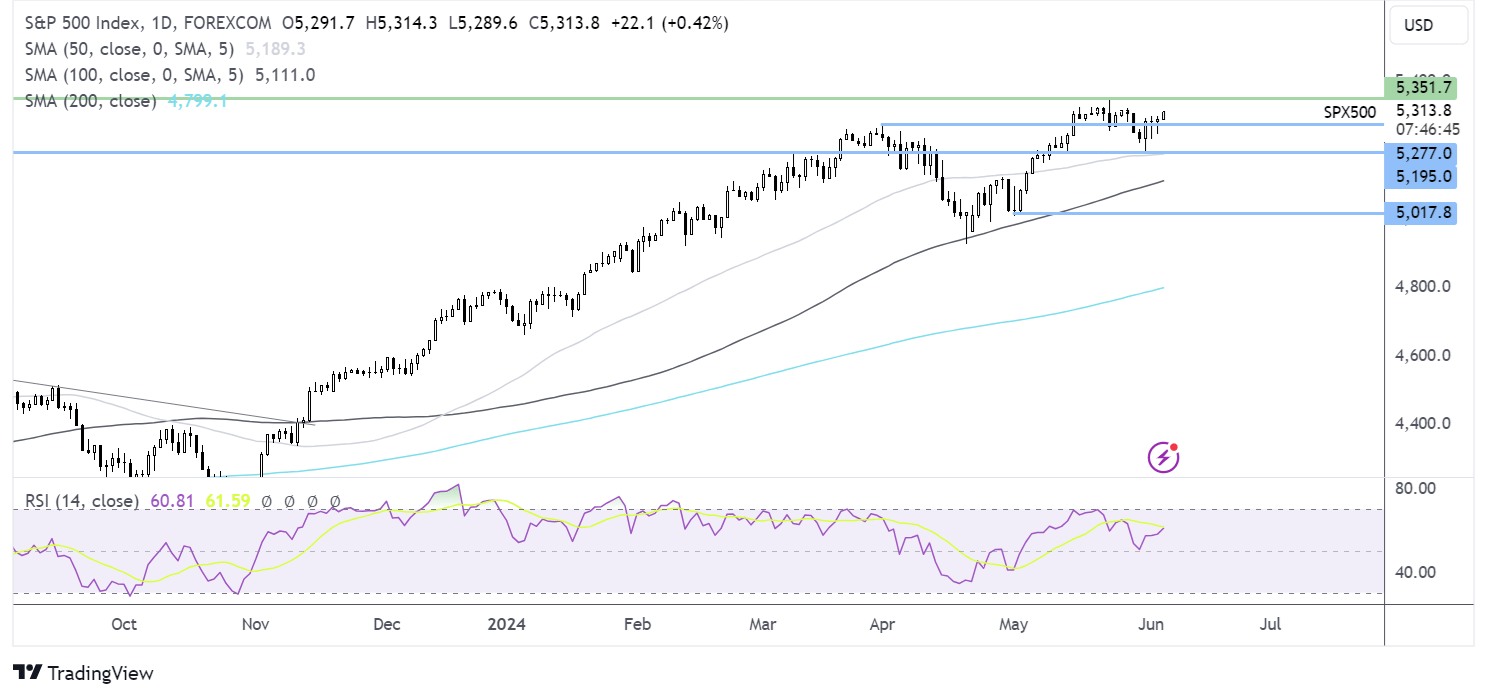

S&P 500 forecast – technical analysis.

After closing Above 5277, the S&P 500 is inching higher, supported by the RSI over 50 and the long lower wicks on recent candles. Buyers will look to extend gains towards 5325 and on to 5350. Immediate support is at 5277, the April high. Below here 5190 the May low comes into play.

FX markets – USD holds steady, GBP/USD rises

The USD is hovering around 2-month lows after more weak data supports the view that the US economy is slowing and the Federal Reserve will cut interest rates sooner.

EUR/USD is flat despite weaker than expected PPI, dropping 1% MoM in April after falling 0.4% in March. The data bodes well for continued cooling in CPI. Meanwhile, the eurozone composite PMI was downwardly revised to 52.2 from 52.3 but is still up from 51.7 in March. Attention is now turning to the ECB rate decision tomorrow, where the central bank is expected to cut rates.

GBP/USD is rising amid an upbeat mood and despite the downward revision to UK services PMI. The service sector PMI pulled back from an 11-month high reached in April to 52.9 in May. The data showed that inflationary pressures also eased, paving the way for the Bank of England to cut interest rates later this summer. Service sector inflation has proved to be sticky and is an area that policymakers are watching closely.

Oil holds steady near a 4-month low

Oil prices are hovering around a 4-month low on Wednesday. Oil prices have been pulled lower over the past week on expectations of increased supply later this year at a time of shaky demand.

The oil selloff has been exasperated since OPEC+ announced plans to phase back production cuts later this year.

However, the Saudi energy minister said that the unwinding of production cuts could be paused or reversed if there wasn't sufficient demand to absorb the increased supply. This appears to have stemmed the sell-off for now.

Oil prices continue to weigh up wweaker than expected U.S. economic data. On the one hand, weak data raises concerns over the health of the US economy and, therefore, the demand outlook. On the other hand, it means that the Fed could be cutting interest rates sooner rather than later.

Separately, adding pressure to oil prices, crude oil stockpiles rose by a more than expected 4 million barrels ahead of the 2.3 million barrels forecast. EIA data is due later today.