- Houthi Red Sea Attack on Israeli Oil tanker leaves more than 200 km of oil slick in water

- US Crude Oil inventories record a third consecutive drop, falling below the 5-year average

- Fed Rate Cut expectations are fueling the bullish sentiment in the broader market

Oil prices rebounded from the $84.30 resistance, encountering a combination of bullish stops, which pulled prices back from the $79.54 low to above the $82 price zone.

Bullish Factors Contributing to the Latest Reversal of Crude Oil:

- US Dollar Index Drop: The US Dollar Index fell to levels last seen in March 2024, influenced by easing monetary policies. This decrease in dollar pressure, combined with a bullish market sentiment, supports increased demand and positive sentiment in the oil market.

- Geopolitical Tensions: To increase pressures towards a ceasefire, Iran-backed Houthis attacked an Israeli oil tanker in the Red Sea amid the Israel-Gaza conflict, causing a 200 km oil slick and disrupting trade routes. This led to higher shipping costs and increased oil prices as other ships had to take longer routes.

- US Crude Oil Inventories: inventories dropped by 4.9 million barrels, down from the previous 3.4-million-barrel decrease and exceeding the expected 0.9-million-barrel drop. This significant decline reflects strong demand during the robust season and heightened economic activity.

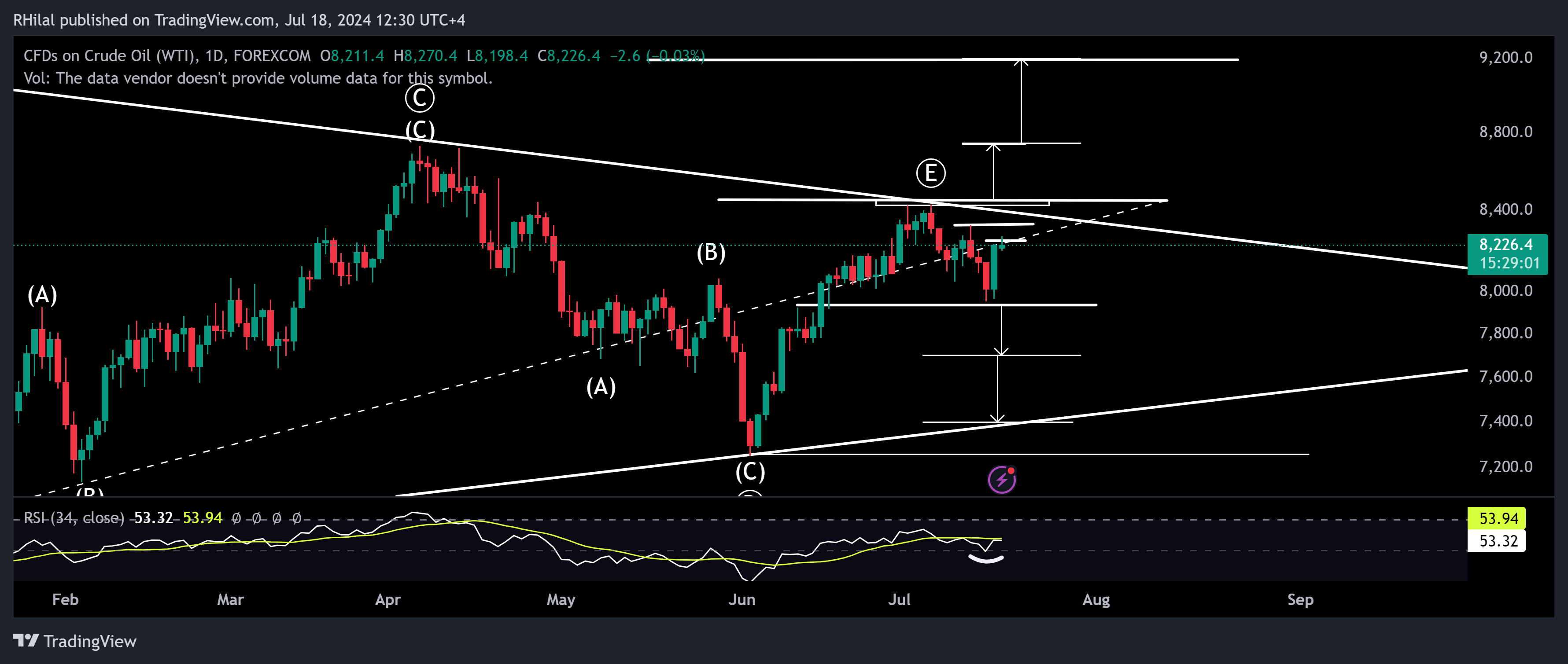

Crude Oil Forecast: USOIL – Daily Time Frame – Log Scale

Source: Tradingview

Market Dynamics

The unity of bullish factors has resulted in a false breakout for the projected head and shoulders pattern, pulling the commodity back above the estimated neckline. The RSI recharged its momentum from the neutral 50 zone supporting the bullish rebound

Overall Analysis

While the overall consolidation of oil remains bearish below the $85 barrier, fluctuations in volatility and preset scenarios are adjusted as follows:

Bullish Scenario and Resistance Levels:

The latest high of $82.70 aligns with the 0.618 Fibonacci retracement of the move between the high and low of July 2024. A break above the mentioned high can lead towards the following level

Short-term Resistance Levels:

- $83.25 (July 12 high)

- $84.30 (July high)

Long-term Resistance Levels:

- A close above the $85 zone is projected to drive the trend towards $87.30 (2024 high) and potentially $92.

Bearish Scenario and Support Levels:

Short-term Support Levels: $80.70 and the latest $79.50 low can support the next drops in oil

Long-term Support Levels: A drop below $79.50 can drive the trend towards $77 and $74 respectively.

--- Written by Razan Hilal, CMT