- Prior strong correlations with gold have fallen by the wayside

- The lack of key drivers puts more emphasis on price to dictate direction

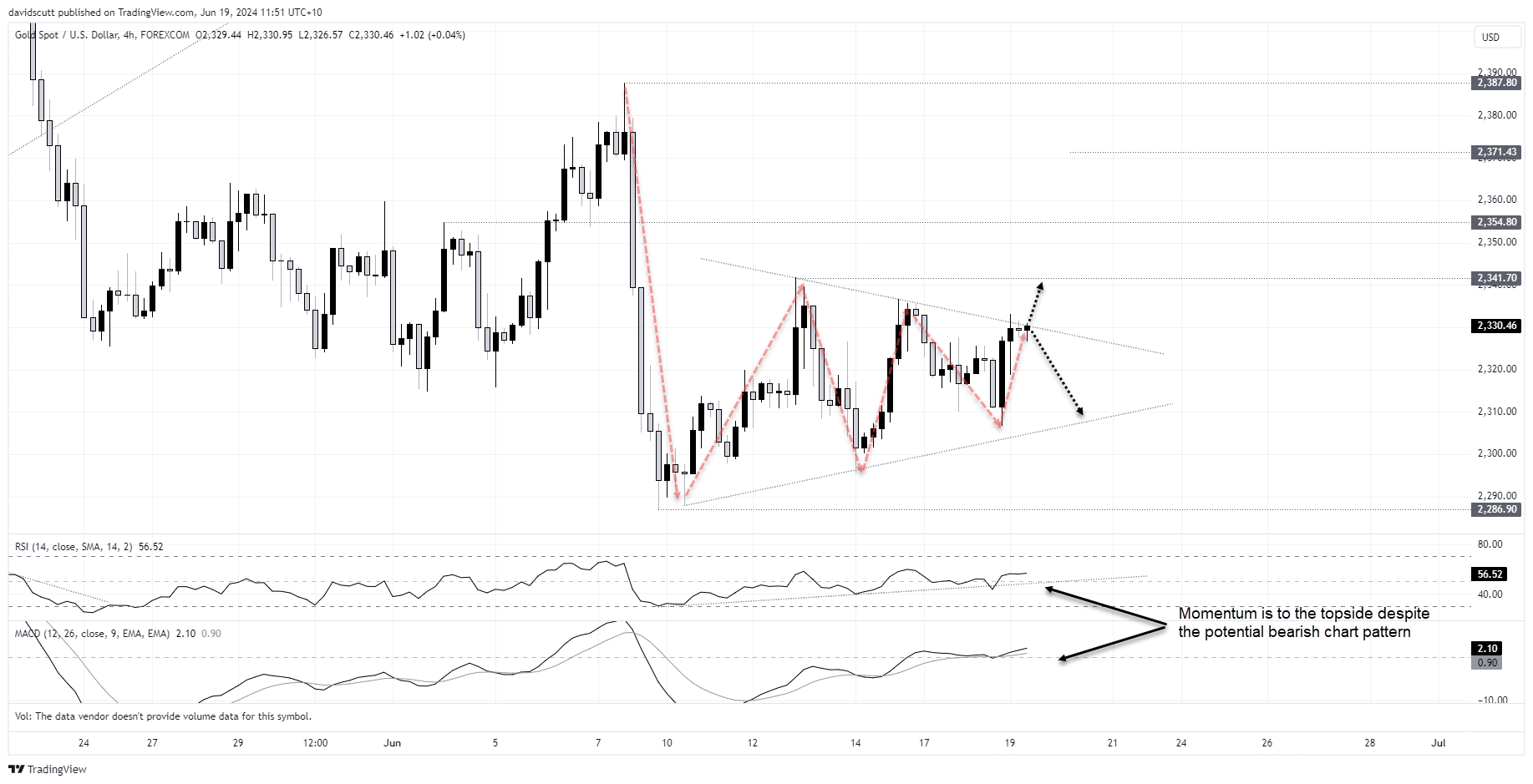

- Gold testing top of bearish pennant pattern

Gold doing its own thing in June

Gold has been dancing to its own tune recently. The strong, positive correlation with other metals has weakened over the past month. So too its relationship with the US dollar and real US bond yields, its traditional drivers – it’s basically nonexistent. WTI crude oil and inflation measures such as breakevens are not even registering on the radar.

With no obvious driver to speak of, it puts more emphasis on the price action for guidance.

Gold price coiling in narrowing range

On the four hourly chart, gold finds itself in a bearish pennant pattern, coiling up within a narrowing range after entering from above. But while that points to the risk of a downside break at some point in the future, for the moment, it not only has bullish momentum behind it but is testing the top of the range, making its near-term price action potentially important for its longer-term trajectory.

Gold attempted to break higher during the past two H4 candles only to get knocked back lower. If the same happens with this attempt, the price action may deliver a potential evening star pattern that’s often seen around market tops. That would also fit with gold revisiting the bottom of the pennant range around $2305. But if it were to break higher on this attempt, it may set the scene for a run towards $2341.70, the peak set on June 12.

Should we see resistance give way, consider buying the break with a stop loss below $2326 for protection. But if the sellers knock it lower again, consider selling with a stop above $2333 for protection.

-- Written by David Scutt

Follow David on Twitter @scutty