Factors Impacting GBPUSD This Week

- Fed Powell Speech

- UK CPI y/y vs Core CPI y/y

- UK Claimant Count Change

Following the positive results from the UK GDP, which rose to a positive change of 0.4% from previous no growth in April, along with positive UK election results and declining US inflation data, the British pound is trading near its 2023 highs. The next fundamental factors that could alter the GBPUSD track are the upcoming speech from Fed Chair Powell, US and UK retail sales, and US and UK unemployment rates.

Fed Powell's speech comes after further confirming data on the sustainability of the declining trend in US inflation, with market participants eagerly awaiting insights on rate cuts, which have already been priced in starting September.

After the Fed’s speech, the UK inflation figures will be reported on Wednesday. The yearly inflation rate is aligning with the target levels necessary to proceed with a rate cut, but core inflation rates remain a challenge for further decreases. Regarding the labor market, the latest claimant count change recorded weaker data with a 50.4k change, above the expected 10.2k, impacting the pair negatively.

The volatility of the US dollar, driven by political challenges and rate cut hopes, alongside upcoming challenges from UK economic indicators, may steer the GBPUSD pair towards a correction this week.

Key Levels to Watch for the Following Week:

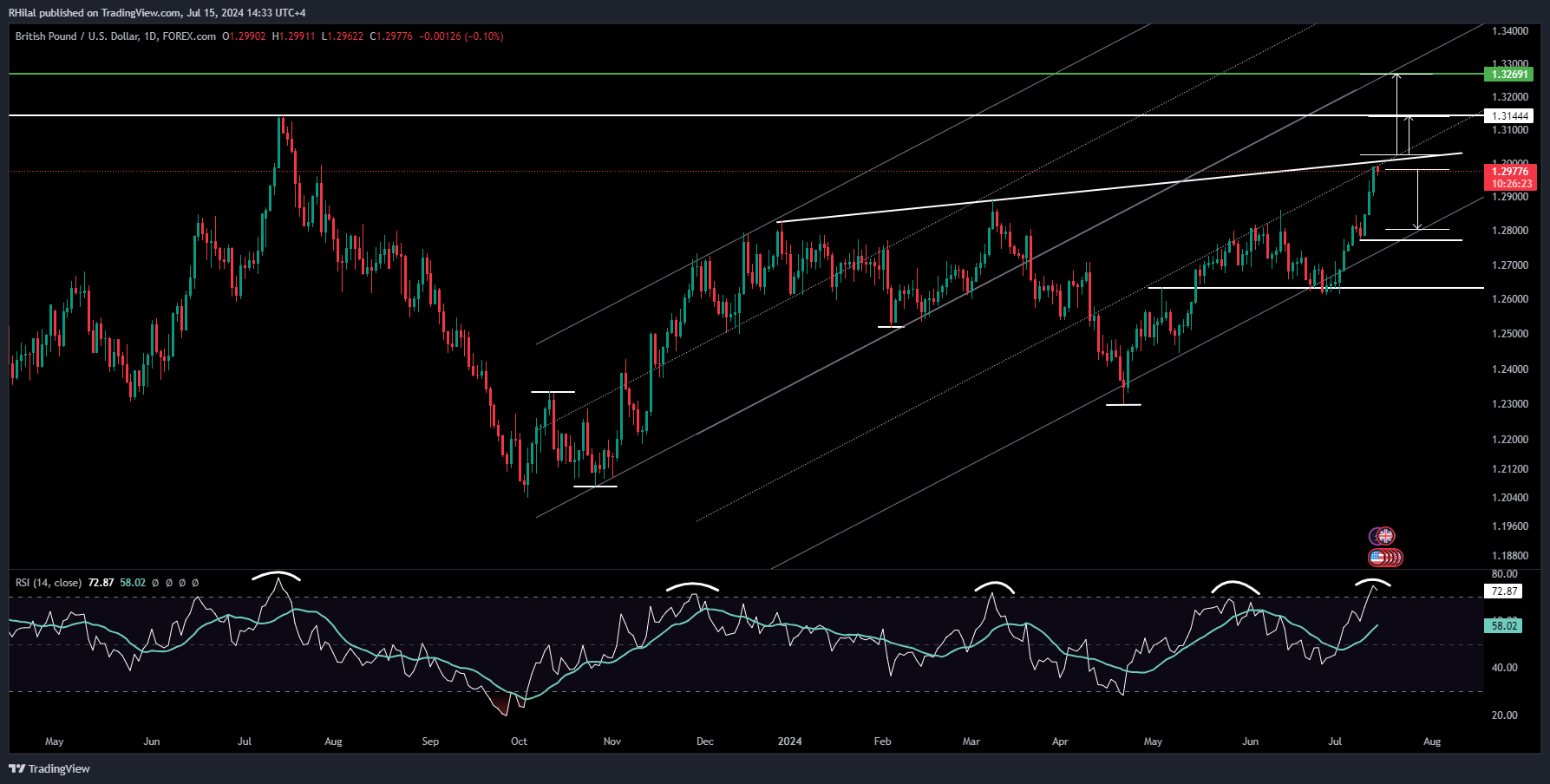

GBPUSD Forecast: GBPUSD – Daily Time Frame – Log Scale:

Source: Tradingview

From a daily time-frame perspective, the trend of the British pound is testing oversold momentum levels, with the relative strength index (RSI) hovering above the 70 level. From a price action perspective, two key resistance levels can be observed:

- The trend connecting the highs of December 2023 and March 2024.

- The mid-level of the parallel channel projected from the trend connecting the October 2023 low and March 2024 high.

A close above the resistance zone, specifically above 1.3030, could pave the way towards 1.3140 (July 2023 high) and subsequently 1.3270.

Conversely, a reversal below 1.29 could lead the British pound towards potential support levels near 1.28-1.2770 and 1.2640.

--- Written by Razan Hilal, CMT